ARISTOTLE CAPITAL BOSTON, LLC

Markets Review

U.S. small cap equities delivered robust performance in the third quarter of 2025, with the Russell 2000 Index reaching its first all-time high since November 2021. The rally was driven by a generally favorable macroeconomic backdrop, including a 25 basis point rate cut by the Federal Reserve in September, which marked a shift toward more accommodative policy amid signs of labor market softening. U.S. GDP growth remained strong at 3.8% in Q2, supported by resilient consumer spending and the easing of trade tensions following tariff rollbacks. Inflation edged higher to 2.9%, driven in part by energy costs and tariff passthroughs, but remained within a manageable range for businesses and consumers. Sentiment was risk-on, fueled by Artificial Intelligence driven optimism as companies with AI exposure or disruptive potential saw disproportionate gains, as investors chased momentum and future earnings potential over traditional valuation metrics. Small caps benefited from dovish Fed rhetoric, attractive relative valuations, broadening of market breadth, earnings recovery and a rotation away from mega cap stocks.

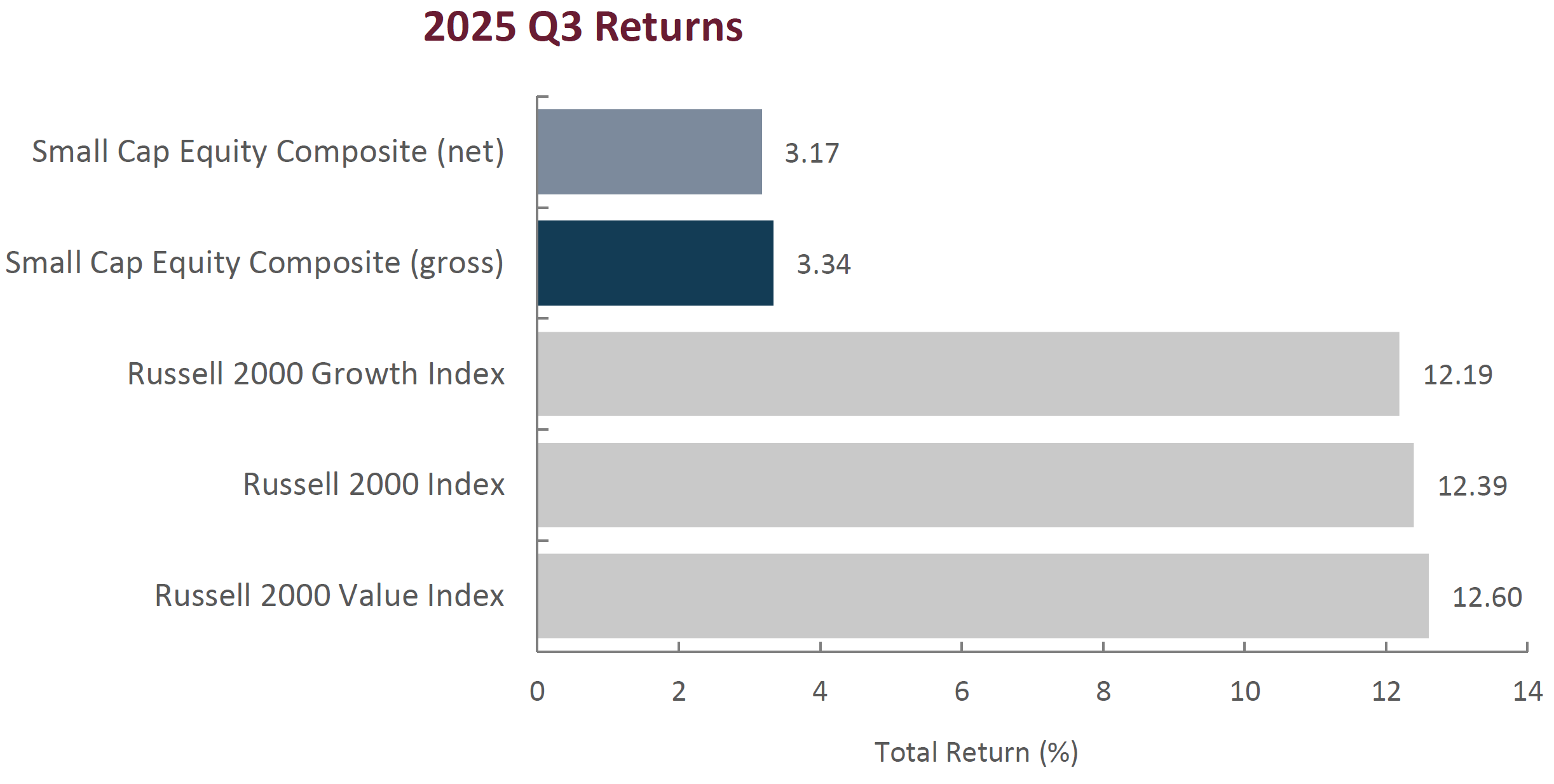

Stylistically, value stocks slightly outperformed their growth counterparts during the quarter as the Russell 2000 Value Index returned 12.60% compared to the 12.19% return of the Russell 2000 Growth index. This may be counterintuitive as growth factors mainly drove the market but the Russell 2000 Value Index’s financials sector weight (2.5x larger than the Russell 2000 Growth Index) significantly benefitted from the cut in interest rates.

From a factor perspective, lower quality companies significantly outperformed higher quality companies during the quarter. Factors that had the strongest payoffs were high beta, momentum, higher volatility, non-earners, high sales growth, micro caps, cyclical and highly shorted stocks.

At the sector level, cyclical stocks outperformed defensive stocks. The best performing sectors were Materials (+25.01%), Industrials (+16.56%), and Communication Services (+16.12%) while the worst performing sectors were Consumer Staples (+1.75%), Financials (+4.34%), and Real Estate (+6.95%).

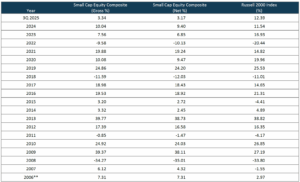

Sources: CAPS Composite Hub, Russell Investments

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Small Cap Equity Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Performance Review

For the third quarter of 2025, the Aristotle Small Cap Equity Composite posted a total return of 3.17% net of fees (3.34% gross of fees), underperforming the 12.39% total return of the Russell 2000 Index. The largest detractor from relative performance was security selection in Industrials, Health Care (a combination of stocks we owned coupled with not owning biotechnology) and Information Technology (not owning quantum computing stocks and non-earning SaaS companies). This was partially offset by strong security selection in the Consumer Discretionary sector coupled with an underweight allocation to Financials and an overweight allocation to Materials.

| Relative Contributors | Relative Detractors |

|---|---|

| Supernus Pharmaceuticals | MACOM Technology Solutions |

| Mercury Systems | Haemonetics |

| Wolverine World Wide | Silgan Holdings |

| Knowles | James Hardie Industries |

| Alamos Gold | HealthEquity |

CONTRIBUTORS

Supernus Pharmaceuticals (SUPN), is a Maryland-based specialty pharmaceutical company focused on developing drugs to treat Central Nervous System diseases. The stock benefitted from strong quarterly results, beating analyst expectations, alongside raising FY25 forecasts. We continue to maintain our position as we believe the company’s differentiated product pipeline, along with its existing neurology products, provides strong growth potential with attractive profitability and free cash flow generation capabilities.

Mercury Systems (MRCY), is a Massachusetts-based technology company focused on delivering processing technology for aerospace and defense missions including signal solutions, display, software applications, networking, storage, and secure processing. The company reported strong earnings, beating analyst expectations, and benefited from its strong position as a supplier to the defense sector. We believe the company will continue to benefit from increased national defense spending as well as revenue expected from their current $1.4B order backlog.

DETRACTORS

MACOM Technology Solutions (MTSI), is a designer and manufacturer of high-performance semiconductor products. Despite reporting strong Q3 earnings, the stock declined as investors reacted to a slight margin impact from a recent acquisition and a slower-than-expected recovery in the industrial market—both short-term deviations from analyst forecasts. We maintain our position, as we believe the company’s meaningful exposure to growing demand from Data Center and 5G end market applications along with the integration of recent acquisitions and domestic manufacturing footprint should drive additional shareholder value in periods to come.

Haemonetics (HAE), is a global provider of hematology and blood management products and solutions. The company delivered mixed results during the quarter, beating analyst earnings estimates but posting weaker than expected revenue results. We believe that the company’s strong competitive position within the plasmapheresis market along with increased investment in research and development should create value for shareholders over a multi-year period.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| Columbia Banking System | 1-800-FLOWERS.COM |

| Dolby Laboratories | ALLETE |

| Hilton Grand Vacations | AZEK |

| James Hardie Industries | Carter’s |

| Knight-Swift Transportation Holdings | Pacific Premier Bancorp |

| ONE Gas | Ring Energy |

| Range Resources | Wabash National |

BUYS/ACQUISITIONS

Columbia Banking System (COLB), is a Washington state based commercial bank that is in the early stages of winding down a large portfolio of low-yielding loans with organically driven higher yielding relationship loans and lower cost core deposit funding. A combination of operational cost savings associated with the Pacific Premier Bancorp merger and an increased focus on increasing fee-based income should allow for higher than historical profit margins and an attractive EPS growth outlook, ultimately allowing for incremental share buybacks or dividend increases.

Dolby Laboratories (DLB), develops and licenses proprietary audio-video technology to content creators, consumer electronics manufacturers, video streaming platforms and automotive manufacturers. Deeper market penetration of its Atmos and Vision technologies with more consumer electronics devices and increasing adoption by auto manufacturers are expected to drive higher margins over the next several years. The company’s capital efficient operating model yields attractive cash flow generation and returns on capital.

Hilton Grand Vacations (HGV), a leading global timeshare company that develops, markets and operates a system of brand-name, high-quality vacation ownership resorts in select vacation destinations, under the brand names: Hilton Vacation Club, Hilton Grand Vacation Club, Hilton Club. HGV’s proprietary relationship with Hilton Worldwide Holdings (HLT) allows it to market exclusively to HLT’s 180 mil Hilton Honors members to capitalize on growing demand for travel. Recent acquisitions broadened the company resort base to include properties appealing to higher income consumers.

James Hardie Industries (JHX), manufactures Fiber Cement and Fiber Gypsum products (siding, backerboard, etc.) used primarily in residential construction (newbuild and repair/remodel). JHX acquired the existing portfolio company, The AZEK Company (AZEK), which provides JHX with a broader product offering for distributors, contractors and homeowners, positioning the company for market share gains in an expanded addressable market. Operating synergies, merger cost synergies and enhanced scale efficiencies should further enhance the shareholder value creation potential.

Knight-Swift Transportation Holdings (KNX), is a North American-based transportation (truckload, less-than-truckload and intermodal) and logistics services provider. KNX is poised to benefit from an increase in freight transportation demand combined with subdued supply of transportation providers. A cyclical upturn in the freight cycle should drive increased revenues, earnings and cash flow, providing the company options to reinvest in the business or return capital to shareholders through share buybacks and/or a dividend increase.

ONE Gas (OGS), is an Oklahoma based, fully regulated gas utility company with service territories in Oklahoma, Kansas and Texas. The company has a proven track record of consistent rate base increases driven by population growth and infrastructure investments. A favorable regulatory backdrop in each of their service territories should allow for continued operational consistency and regular modest dividend increases, creating an attractive total return opportunity for the portfolio.

Range Resources (RRC), is a Texas based exploration and production company focused on extracting natural gas from the Marcellus Shale and Utica Shale formations within the Pennsylvania portion of the Appalachian Basin. The company’s large acreage position (800k Marcellus acres) provides a deep inventory (30+ yrs) of low-cost development locations that are expected to allow the company to capitalize on increased global demand for natural gas. Opportunities for increased drilling efficiencies should lower total operating costs, enhance earnings and drive greater cash flow generation that can be used to enhance shareholder value over the next several years.

SELLS/LIQUIDATIONS

1-800-FLOWERS.COM (FLWS), is an e-commerce provider of floral and gift products. The position was liquidated due to an increasingly uncertain fundamental outlook.

ALLETE (ALE), is a Minnesota based electric utility company. The position was liquidated ahead of its pending acquisition by a private equity consortium.

AZEK (AZEK), is a manufacturer of composite decking products for primarily residential applications. The company was acquired by James Hardie Industries plc (JHX).

Carter’s (CRI), is a manufacturer, distributor and retailer of infant and young children’s apparel. The position was liquidated due to deteriorated fundamental performance and an uncertain strategic outlook.

Pacific Premier Bancorp (PPBI), a California based bank holding company, was acquired by Columbia Banking System (COLB).

Ring Energy (REI), is an oil and gas exploration company, which engages in acquisition, exploration, development, and production activities. The position was liquidated due to the energy market outlook weakening thus delaying management’s strategic plan to scale through acquisitions and generate necessary operational efficiencies.

Wabash National (WNC), a manufacturer of dry freight and refrigerated semi-trailers, was liquidated due to uncertain fundamental outlook.

Outlook

We continue to remain optimistic about the long-term potential for the small-cap segment of the U.S. market. Valuations remain compelling relative to large caps, with the Russell 2000 Index trading near multi-decade lows on a relative basis. Potential tailwinds, including deregulation, lower corporate tax rates, increased M&A activity, continued reshoring of U.S. manufacturing, and infrastructure-related spending, could provide additional support for small-cap stocks. Volatility remains elevated over concerns around inflationary risks, geopolitical tensions, and potential U.S. economic and labor weakness.

Positioning

Our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Overweight allocations in Information Technology and Industrials are mostly a function of our underlying company specific views rather than any top-down predictions for each sector. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling long-term opportunities that fit our discipline given the rising risk profiles of many retail businesses and a potential deceleration in goods spending following a period of strength. We are also underweight in Health Care as we do not hold Biotechnology companies as that industry has significant binary risk. Given our focus on long-term business fundamentals, our patient investment approach and low portfolio turnover, the strategy’s positioning generally does not change significantly from quarter to quarter. However, we may take advantage of periods of volatility by adding selectively to certain companies when appropriate.

The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice.

Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. While Large-capitalization companies may have more stable prices than smaller, less established companies, they are still subject to equity securities risk. In addition, large-capitalization equity security prices may not rise as much as prices of equity securities of small-capitalization companies. Securities of small- and medium-sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Boston does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2510-17

Sources: CAPS Composite Hub, Russell Investments

Composite returns for periods ended September 30, 2025, are preliminary pending final account reconciliation.

*The Aristotle Small Cap Equity Composite has an inception date of November 1, 2006, at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015, was achieved at Aristotle Boston.

**For the period November 2006 through December 2006.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Please see important disclosures enclosed within this document.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index. It includes approximately 2,000 of the smallest securities based on a combination of their market capitalization and current index membership. The Russell 2000 Growth® Index measures the performance of the small cap companies located in the United States that also exhibit a growth probability. The Russell 2000 Value® Index measures the performance of the small cap companies located in the United States that also exhibit a value probability. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices.