Commentary

Small Cap Equity 1Q 2025

ARISTOTLE CAPITAL BOSTON, LLC

Markets Review

The volatility observed throughout 2024 persisted into the first quarter of 2025. The Russell 2000 Index approached correction territory with a loss of -9.48% for the quarter, following a solid 2024 with the index returning 11.54%. After a moderately positive start to the quarter, February and March were a more challenging market environment due to uncertainty surrounding the precise parameters and implementation of the new administration’s policies, geopolitical tensions and a higher for longer rate environment. Continued economic growth, a stable labor market and firmer inflation data kept the Federal Reserve (Fed) on the more hawkish course they took in December. Chairman Powell held rates steady at the March FOMC meeting and indicated the Fed will maintain a more measured approach going forward, updating their economic projections and forecasts to two rate cuts in 2025.

Stylistically, value stocks outperformed their growth counterparts during the quarter as the Russell 2000 Value Index returned -7.74% compared to the -11.12% return of the Russell 2000 Growth index. This is a reversal from last year where growth significantly outperformed value.

From a factor performance perspective, the quarter saw a change in market preference to higher-quality companies, favoring dividend-paying, defensive stocks. This change in sentiment was due in part to level interest rates, moderating US economic activity, and an increase in recession risk.

At the sector level, defensive sectors outperformed cyclical sectors, with Utilities (+5.28%), a sector often perceived as a bond proxy, being the only sector in the Russell 2000 Index to post a positive return during the quarter. The worst performing sectors were Information Technology (-18.39%), Consumer Discretionary (-14.91%), Energy (-12.95%), Communications (-12.51%) and Industrials (-11.03%) while Utilities (+5.28%), Health Care (-8.29%), Materials (-6.96%), Financials (-4.35%), Real Estate (-3.28%) and Consumer Staples (-0.07%) performed best.

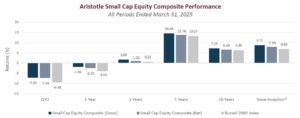

Sources: CAPS Composite Hub, Russell Investments

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Small Cap Equity Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Performance Review

For the first quarter of 2025, the Aristotle Small Cap Equity Composite posted a total return of -7.34% net of fees (-7.20% gross of fees), beating the -9.48% total return of the Russell 2000 Index. Outperformance was driven by strong security selection in the Information Technology, Industrials and Materials sectors coupled with an underweight allocation to Consumer Discretionary. Security selection in Consumer Discretionary, Consumer Staples and Energy coupled with an overweight allocation to Information Technology detracted.

| Relative Contributors | Relative Detractors |

|---|---|

| Alamos Gold | Columbus McKinnon |

| Huron Consulting Group | MACOM Technology Solutions |

| MACOM Technology Solutions | Wolverine World Wide |

| AerCap Holdings | ASGN Incorporated |

| Merit Medical Systems | Knowles Corp |

CONTRIBUTORS

Alamos Gold (AGI-CA), engages in the exploration, development, mining and extraction of precious metals. The company benefited from rising gold prices as investors purchased the commodity as an inflation hedge. We maintain our investment as we believe in the company’s lower geopolitical risk profile, solid production growth plan from 600k oz to 1M oz per year over the next five years, and strong operational track record.

Huron Consulting Group (HURN), a specialty consulting company that provides financial, operational, and digital consulting services to health care, education and commercial clients, appreciated after delivering strong results highlighted by continued momentum within the company’s health care and commercial segments, more than offsetting the education segment. We maintain our investment, as we believe the company remains well-positioned to capitalize on a demand backdrop aided by financial and operational pressures in its largest end-markets, along with secular tailwinds supporting digital transformation, analytics and cloud consulting.

DETRACTORS

Columbus McKinnon (CMCO), engages in the design, manufacture, and marketing of material handling products and systems. The company came under pressure following the announcement of its intent to acquire Kito Crosby, a global provider of lifting solutions and securement. Investor concern about the size and financing of the deal contributed to the weakness. We continue to maintain a position, for now, as we continue to evaluate the risk/reward potential associated with the deal.

MACOM Technology Solutions (MTSI), a designer and manufacturer of high-performance semiconductor products, declined along with the broader semiconductor industry during the quarter. We maintain our position, as we believe the company’s meaningful exposure to growing demand from Data Center and 5G end market applications along with the integration of recent acquisitions should drive additional shareholder value in periods to come.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| Agree Realty Corporation | Avid Bioservices |

| Old National Bancorp | Barnes Group |

| Valvoline | Designer Brands |

| Veeco Instruments | Flushing Financial |

| ModivCare | |

| Summit Materials |

BUYS/ACQUISITIONS

Agree Realty Corporation (ADC), is a real estate investment trust that owns, manages and develops primarily neighborhood community shopping centers and single tenant properties leased to major retail tenants such as Sherwin-Williams, Wal-Mart and TJX Companies. We believe the company’s high-quality portfolio, recession resistant retail categories and strong balance sheet coupled with management’s proactive tenant management and acquisition pipeline will benefit the company on a go-forward basis.

Old National Bancorp (ONB), is a regional bank serving clients primarily in the Midwest and Southeastern U.S. We believe the company’s geographic location, strong balance sheet, increased loan growth and repricing of fixed-rate loans to higher rates will benefit NIMs on a go-forward basis.

Valvoline (VVV), is a pure-play auto quick lube and maintenance service provider with over 2,000 locations in the U.S. and Canada. The company provides quick and convenient stay-in-your-car automotive preventative maintenance through its full-service oil changes from skilled technicians in less than 15minutes. We believe the company will benefit from increased market share gains, driven by both corporate and franchise expansion, growing its scale, accelerating growth and increasing its moat.

Veeco Instruments (VECO), engages in the development, manufacture, sale, and support of semiconductor process equipment. Its technologies consist of metal organic chemical vapor deposition, advanced packaging lithography, wet etch and clean, laser annealing, ion beam, molecular beam epitaxy, wafer inspection, and atomic layer deposition systems. The company should benefit from the evolution of the semiconductor chip as manufacturers seek new technologies to enhance the manufacturing process that will enable them to produce smaller and faster chips.

SELLS/LIQUIDATIONS

Avid Bioservices (CDMO), is a dedicated biologics Contract Development and Manufacturing Organization working to improve patient lives by providing high quality development and manufacturing services to biotechnology and pharmaceutical companies. The company was acquired and taken private by GHO Capital and Ampersand Capital Partners.

Barnes Group (B), is a globally recognized industrial and aerospace manufacturer and service provider that stands out for its highly engineered products, differentiated industrial technologies, and innovative solutions. The company was acquired and taken private by Apollo Funds.

Designer Brands (DBI), is a North American company which engages in the design, production, and retail of footwear and accessory brands. We sold the position due to deteriorating corporate fundamentals.

Flushing Financial (FFIC), a NY-based regional bank holding company, was sold because the shares had reached our valuation target.

ModivCare (MODV), is a Colorado-based healthcare services company that provides non-emergency medical transportation (NEMT), homecare services, and remote patient monitoring to Medicaid and Medicare populations. We sold the position due to a deteriorating fundamental outlook that resulted in a deteriorating financial position.

Summit Materials (SUM), is a North American supplier of aggregates, cement, and ready-mix concrete for the construction industry. The company was acquired by Quikrete Holdings, Inc.

Outlook

We continue to remain optimistic about the long-term potential for the small-cap segment of the U.S. market. Valuations remain compelling relative to large caps, with the Russell 2000 Index trading near multi-decade lows on a relative basis. Potential tailwinds, including deregulation, lower corporate tax rate, increased M&A activity, continued reshoring of U.S. manufacturing, and infrastructure-related spending, could provide additional support for small-cap stocks. There may be some short-term volatility as the new administration’s policies are implemented and absorbed by markets. We also remain mindful of risks such as inflation reaccelerating, increased geopolitical tensions, and potential U.S. economic weakness.

Positioning

Our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Overweights in Industrials and Information Technology are mostly a function of our underlying company specific views rather than any top-down predictions for each sector. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling long-term opportunities that fit our discipline given the rising risk profiles of many retail businesses and a potential deceleration in goods spending following a period of strength. While the portfolio’s allocation to Health Care is modestly below that of the benchmark, we continue to remain underweight the Biotechnology industry as many companies within that group do not fit our discipline due to their elevated levels of binary risk. Meanwhile we have found more opportunities for steady company growth within the Provider, Services and Equipment industry group so more of our exposure is to that area of Health Care. Given our focus on long-term business fundamentals, patient investment approach and low portfolio turnover, the strategy’s sector positioning generally does not change significantly from quarter to quarter. However, we may take advantage of periods of volatility by adding selectively to certain companies when appropriate.

The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice.

Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs.

These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments.

The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2504-19

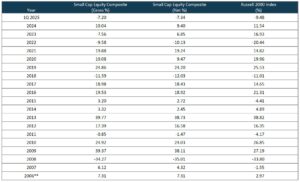

Sources: CAPS Composite Hub, Russell Investments

Sources: CAPS Composite Hub, Russell Investments

Composite returns for periods ended March 31, 2025, are preliminary pending final account reconciliation.

*The Aristotle Small Cap Equity Composite has an inception date of November 1, 2006, at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015, was achieved at Aristotle Boston.

**For the period November 2006 through December 2006.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Please see important disclosures enclosed within this document.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Growth® Index measures the performance of the small cap companies located in the United States that also exhibit a growth probability. The Russell 2000 Value® Index measures the performance of the small cap companies located in the United States that also exhibit a value probability. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices.