Commentary

Small Cap Equity 4Q 2023

ARISTOTLE CAPITAL BOSTON, LLC

Markets Review

As we’ve highlighted several times throughout the year, volatility was a recurring theme for most of 2023 and the fourth quarter was no exception. Following a sluggish start to the quarter, small cap stocks rallied off their October lows and ended the period with a double-digit gain. For the quarter, the Russell 2000’s gain of 14.03% outpaced the 11.96% total return of the Russell 1000 Index, marking the first quarterly outperformance period for the small cap index since the third quarter of 2022. Overall equity performance continued to be tightly correlated to 10-year US Treasury bond yields. When yields rose in October, stocks fell sharply. Yields collapsed in November and December, and stocks rallied. The Federal Reserve’s dovish commentary was a primary catalyst for the ‘everything-rally’ that ensued into year end. At the mid-December meeting, Chairman Powell made public comments that suggested the Fed had interest rate cuts on its mind, saying cuts were “a topic of discussion” among Federal Reserve members. At the time of this writing, markets are currently pricing in several rate cuts in 2024, however, the situation remains fluid as a host of uncertainties could potentially alter the pace and direction of policy moves throughout the year.

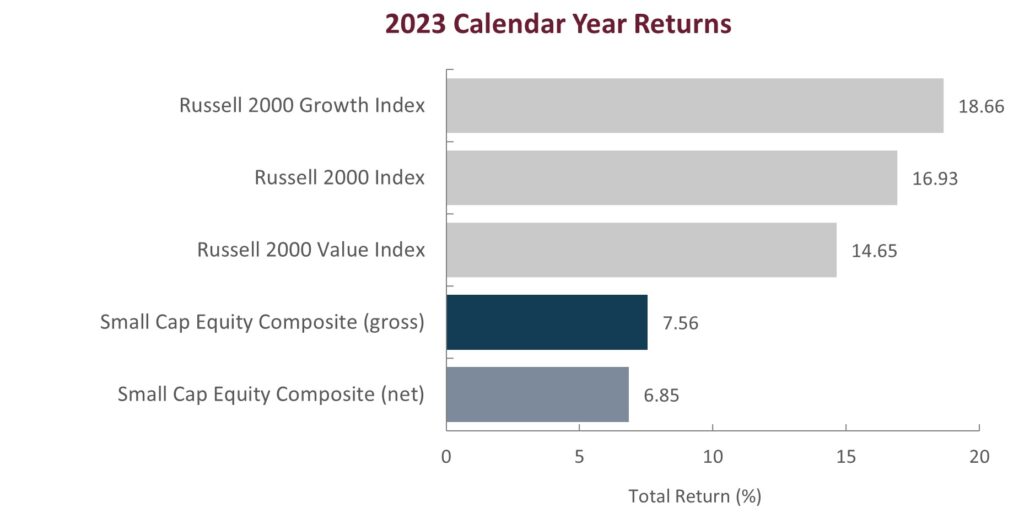

Stylistically, value stocks outperformed their more expensive growth counterparts during the quarter as evidenced by the Russell 2000 Value Index returning 15.26% compared to 12.75% for the Russell 2000 Growth Index. For 2023 as a whole, however, the Russell 2000 Growth Index led, gaining 18.66% versus 14.65% for the Russell 2000 Value. Factor performance was decidedly mixed during the fourth quarter, although companies with negative earnings, high short interest, and low ROE & ROIC were among the strongest performers into year end, indicating a lower quality skew to the Russell 2000 rally during the period.

At the sector level, ten of the eleven sectors in the Russell 2000 Index recorded positive returns during the fourth quarter, led by robust returns in the Financials (+21.56%), Consumer Discretionary (+17.39%) and Real Estate (+16.86%) sectors. Conversely, Energy (-6.03%), Utilities (+7.83%), and Communication Services (+9.68%) all underperformed. For the full year, Information Technology, Consumer Discretionary and Industrial fared best. Utilities was the lone sector to finish in negative territory while Health Care and Communication Services also lagged.

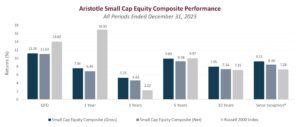

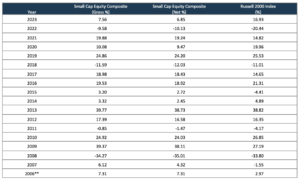

Sources: CAPS Composite Hub, Russell Investments

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Small Cap Equity Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Performance Review

For the fourth quarter of 2023, the Aristotle Small Cap Equity Composite posted a total return of 11.02% net of fees (11.18% gross of fees), trailing the 14.03% total return of the Russell 2000 Index. Underperformance was driven by a combination of security selection and allocation effects. Overall, security selection was weakest within the Health Care, Information Technology and Consumer Staples sectors and strongest in Utilities, Financials and Materials. From an allocation perspective, underweights in Financials and Consumer Discretionary detracted from relative returns but were partially offset by underweights in Energy and Communication Services which contributed.

| Relative Contributors | Relative Detractors |

|---|---|

| SP Plus | Oceaneering International |

| Customers Bancorp | Belden |

| ACI Worldwide | Patterson-UTI Energy |

| Viad | Huron Consulting |

| HASI | Designer Brands |

CONTRIBUTORS

SP Plus (SP), a provider of parking management, payment services, facility maintenance and event logistics solutions, appreciated following an announcement that the company would be acquired by Metropolis Technologies. We maintain a position ahead of the expected close of the transaction in 2024.

Customers Bancorp (CUBI), a Pennsylvania-based regional bank, benefited from strong fundamental performance and improved sentiment following the company’s latest earnings release after the company reported net interest margin expansion alongside, solid credit, capital, and broader business trends. We maintain our investment as we believe management’s focus on accumulating capital, limiting balance growth, and remixing loans and deposits into higher value-add verticals should create additional shareholder value in periods to come.

DETRACTORS

Oceaneering International (OII), a global technology company delivering engineered services, products and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries, declined during the period amid a pullback in energy prices and conservative management commentary around the company’s near-term outlook. We maintain a position, as we believe the company should continue to benefit from future increases in offshore activity along with continued growth within its industrial robotics business segment.

Belden (BDC), a manufacturer and seller of connectors, cables, and networking gear to help its customers acquire, transmit, manage, and orchestrate data, declined during the period amid a weaker demand environment, pauses in capital spending, and channel de-stocking. Despite these near-term pressures, we maintain our position as we believe the company’s ongoing transition from being mostly a commoditized component supplier to a complete solutions provider can drive margin expansion. Furthermore, we believe the company’s focus on serving secularly attractive end markets of Industrial Automation, Cybersecurity, Broadband & 5G, and Smart Buildings will position the company favorably over the long term.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| Northern Oil & Gas | Coherus Biosciences |

BUYS/ACQUISITIONS

Northern Oil & Gas (NOG), a leading non-operated working interest franchise in the premier shale basins across the United States, was added to the portfolio. Overall, we believe the company’s ability to opportunistically add high-quality acreage in multiple basins remains a key differentiator for the stock. Furthermore, we believe the company’s scale and proprietary database built from participation in over 9,800 wells provides management with intimate knowledge and the ability to make swift and informed capital allocation decisions.

SELLS/LIQUIDATIONS

Coherus Biosciences (CHRS), a commercial-stage biopharmaceutical company engaged in the development and commercialization of biosimilar and immune-oncology therapeutics for major regulated markets, was removed from the portfolio. Despite the company’s efforts to grow and diversify its revenue base through a series of upcoming product launches, a variety of factors contributed to our decision to step away from our investment including a shift in company focus, competitive pricing pressures, and a recent C-suite departure.

Outlook

Compared to late 2022, when the market seemed to be bracing for a recession, the end of 2023 seems to indicate a more optimistic tone as we move into the new year. Recent sentiment has been boosted by optimism of falling inflation and dovish messaging out of the Federal Reserve, although we acknowledge that the market’s enthusiasm on this matter in recent months may be overly optimistic. Regardless of any forthcoming policy decisions, we are reminded that the days of zero interest rates and easy access to capital have likely come to an end. Our view is that an end to the ‘public venture capital’ mindset that has dominated small cap markets in recent years should give way to a renewed focus on profits, cash flows and balance sheet strength, which should be beneficial for fundamentally oriented active managers. In the near term, we continue to focus our efforts on the risks associated with individual investment positions under various potential scenarios instead of attempting to forecast Fed policy or interest rate moves. Based on our recent conversations with management teams, we believe the economic environment can be characterized as “good, not great” which is an improvement from this time last year, when many believed a recession was imminent both domestically and across the globe. In many ways, 2023 was another reminder that asset allocators must learn to expect the unexpected. We see that theme continuing into the new year, especially in the face of an uncertain economic backdrop and looming presidential election.

Regarding the impact on small caps, we believe macro concerns have been a drag on investor sentiment, which, once again, negatively impacted the asset class relative to large caps in 2023. Relief in this area and an improvement in the forward outlook could have the opposite effect and provide a relative boost for small caps in 2024. Valuations of small versus large continue to remain near multi-decade lows, which we believe suggests a more favorable setup for small caps relative to large caps in the periods to come (14.7x P/E for the Russell 2000 Index vs. 23.3x P/E for the Russell 1000 Index). Additionally, earnings and sales growth are expected to improve for small & mid caps in 2024 and outpace that of large caps, which we believe provides further fundamental support and potential upside for the asset class. Against a backdrop of moderating inflation, normalized interest rates, and a still growing U.S. economy, it looks to us that small-cap’s lengthy stretch of relative underperformance may be long in the tooth. If the economy continues to stabilize, our view is that valuations are likely to rise for those businesses that have largely sat out the mega-cap performance regime. It also helps that the well-noted concentration in large caps is reaching 50-year highs and small cap valuation relative to large cap is at multi-decade lows, therefore any fundamentally driven repositioning is likely to benefit small caps more than larger companies, in our view. Lastly, large cap cycles have historically peaked at market tops crowded with mega caps, a scenario we find ourselves in today.

Positioning

Our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Overweights in Industrials and Information Technology are mostly a function of our underlying company specific views rather than any top-down predictions for each sector. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling long-term opportunities that fit our discipline given the rising risk profiles of many retail businesses and a potential deceleration in goods spending following a period of strength. While the portfolio’s allocation to Health Care is modestly below that of the benchmark, we continue to remain underweight the Biotechnology industry as many companies within that group do not fit our discipline due to their elevated levels of binary risk. Given our focus on long-term business fundamentals, patient investment approach and low portfolio turnover, the strategy’s sector positioning generally does not change significantly from quarter to quarter. However, we may take advantage of periods of volatility by adding selectively to certain companies when appropriate.

The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice.

Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Effective January 1, 2022, the Russell 2000 Value Index was removed as the secondary benchmark for the Aristotle Capital Boston Small Cap Equity strategy.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs.

These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments.

The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass.

The firm’s coverage of Signature Bank includes time at a predecessor firm.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2401-21

Sources: CAPS Composite Hub, Russell Investments

Composite returns for periods ended December 31, 2023 are preliminary pending final account reconciliation.

*The Aristotle Small Cap Equity Composite has an inception date of November 1, 2006 at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015 was achieved at Aristotle Boston.

**For the period November 2006 through December 2006.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Effective January 1, 2022, the Russell 2000 Value was removed as the secondary benchmark for the Aristotle Capital Boston Small Cap Equity strategy.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Please see important disclosures enclosed within this document.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Growth® Index measures the performance of the small cap companies located in the United States that also exhibit a growth probability. The Russell 2000 Value® Index measures the performance of the small cap companies located in the United States that also exhibit a value probability. The Russell 1000® Index measures the performance of the large cap segment of the U.S. equity universe. The Russell 1000 Index is a subset of the Russell 3000® Index, representing approximately 90% of the total market capitalization of that index. It includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices.