Commentary

Small Cap Equity 3Q 2023

ARISTOTLE CAPITAL BOSTON, LLC

Markets Review

The Russell 2000 reversed course after rising over 6% in the month of July, falling -10.6% in August and September, and closing out the quarter with a return of -5.13%. Performance was weaker down the cap spectrum with the Russell 2000 trailing the Russell 1000 for the fourth consecutive quarter, bringing the year-to-date gap between the two indices to 10.47% in favor of large caps. In spite of large caps recent streak of outperformance, many have noted the narrowness of the large cap market rally this year, with a select group of mega cap stocks coined the ‘Magnificent 7’ having driven the vast majority of large cap index gains so far this year. Surging oil prices and treasury yields, a broader and more protracted United Auto Workers strike, and the resumption of student loan payments all contributed to subdued market sentiment into quarter end. On the policy front, even as decades-high inflation showed meaningful signs of slowing, the Fed disappointed some investors’ expectations of a quick pivot to cutting rates. Instead, the central bank indicated its resolve to keep interest rates higher for longer in mid-June, deciding to hold off on raising interest rates as it takes stock of how its prior rate hikes are impacting the real economy.

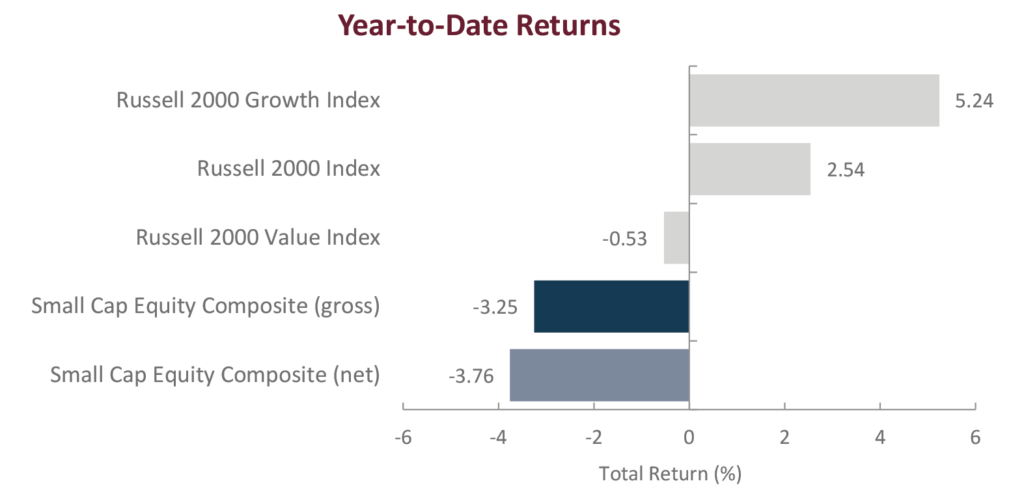

Stylistically, value stocks proved relatively resilient versus their more expensive growth counterparts during the quarter as evidenced by the Russell 2000 Value Index returning -2.96% compared to -7.32% for the Russell 2000 Growth Index. The gap between the two styles remains wide on a year-to-date basis, however, with the Russell 2000 Growth Index having outperformed its value counterpart by more than 5% so far in 2023.

At the sector level, nine of the eleven sectors in the Russell 2000 Index generated negative returns during the third quarter and only three sectors generated returns ahead of the broader index, representing a second consecutive quarter of narrow sector leadership for the Index. Energy and Financials were the only sectors to deliver gains during the period with returns of 18.62% and 1.21%, respectively. Energy is also the only sector to be up in each of the last two quarters and now leads all sectors on a year-to-date basis after lagging through the first half of the year. Health Care (-15.14%) and Utilities (-11.75%) both ended the quarter with double digit declines and are lagging the Index on a year-to-date basis.

Sources: CAPS Composite Hub, Russell Investments

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Small Cap Equity Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Performance Review

For the third quarter of 2023, the Aristotle Small Cap Equity Composite posted a total return of -5.77% net of fees (-5.57% gross of fees), trailing the -5.13% total return of the Russell 2000 Index. Underperformance was driven by a combination of security selection and allocation effects. Overall, security selection was weakest within the Consumer Staples, Financials and Consumer Discretionary sectors and strongest in Health Care, Information Technology and Utilities. From an allocation perspective, the portfolio benefited from underweights in Health Care and Consumer Discretionary, however, this was offset by underweights in Energy and Financials.

| Relative Contributors | Relative Detractors |

|---|---|

| Huron Consulting Group | Euronet Worldwide |

| MACOM Technology Solutions | Dycom |

| Oceaneering International | Merit Medical Systems |

| HealthEquity | Monro |

| PetIQ | Nu Skin Enterprises |

CONTRIBUTORS

Huron Consulting Group (HURN), a specialty consulting company that provides financial, operational, and digital consulting services to health care, education and commercial clients, appreciated after delivering strong results highlighted by continued momentum within the company’s health care and education segments. We maintain our investment, as we believe the company remains well-positioned to capitalize on a demand backdrop aided by financial and operational pressures in its largest end-markets, along with secular tailwinds supporting digital transformation, analytics and cloud consulting.

MACOM Technology Solutions (MTSI), a designer and manufacturer of high-performance semiconductor products, appreciated amid strength within its Industrial and Defense segment along with positive commentary around future AI data center demand. We maintain our position, as we believe the company’s meaningful exposure to growing demand from Data Center and 5G end market applications along with the integration of recent acquisitions should drive additional shareholder value in periods to come.

DETRACTORS

Euronet Worldwide (EEFT), a provider of electronic payment and financial transaction solutions, declined during the period amid inflationary pressures and rising travel costs, leaving consumers with fewer funds for discretionary tourism spending and ultimately resulting in a negative impact on its Electronic Funds Transfer segment. We maintain our investment, as we believe the company’s expansion into mobile and digital payments combined with a continued recovery in international travel can benefit shareholders in the periods to come.

Dycom (DY), a provider of engineering and construction services to the telecommunications and cable television industries, declined amid uncertainty regarding near term customer capital spending initiatives and their ensuing impact on fiber capex plans. We maintain a position as we believe the company remains well positioned for longer term growth alongside secular trends for expanding fiber deployments to support faster broadband connectivity speeds and opportunities to deploy fiber to rural or underserved areas across the country.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| Patterson-UTI Energy | CalAmp |

| TKO Group Holdings | NexTier Oilfield Solutions |

| U.S. Xpress Enterprises | |

| World Wrestling Entertainment |

BUYS/ACQUISITIONS

Patterson-UTI Energy (PTEN), an oilfield services company focused on drilling and pressure pumping solutions was added to the portfolio following its merger with NexTier Oilfield Solutions. Overall, we maintain a positive view on the business combination as the merging of the two entities creates a comprehensive drilling and completions franchise with leadership positions in contract drilling, pressure pumping and directional drilling. Furthermore, we believe the company will benefit from greater size and scale, synergistic cost savings initiatives, and a more diversified suite of offerings to serve its customers.

TKO Group Holdings (TKO), a global sports and entertainment company formed through the merger of UFC and WWE, was added to the portfolio during the quarter. With assets spanning media & content, live events, sponsorship and licensing, we believe the company should be able to continue to capitalize on the booming global sports and entertainment ecosystem. Additionally, we believe the company’s diverse global fan base and strategic international expansion plans position the company well amidst favorable industry growth trends and an ever-evolving media rights landscape.

SELLS/LIQUIDATIONS

CalAmp (CAMP), a supplier of Mobile Resource Management solutions that allow for the remote collection of data from vehicles and other assets was removed from the portfolio during the quarter. In spite of the company’s efforts to convert its customer base from a hardware to a subscription model, redesign its customer support systems, and introduce new products in recent years, a variety of factors contributed to the harvesting of these efforts being pushed out, unfavorably impacting the risk-reward profile of the business. Therefore, we decided to eliminate the position.

NexTier Oilfield Solutions (NEX), a provider of hydraulic fracturing and other completion-oriented oilfield services to exploration and production companies in the U.S. was removed from the portfolio by virtue of its merger with Patterson-UTI Energy.

U.S. Xpress Enterprises (USX), a Tennessee-based trucking company was removed from the portfolio after being acquired by Knight-Swift Transportation.

World Wrestling Entertainment (WWE), an integrated media and entertainment company, was removed from the portfolio following its merger with Endeavor Group-owned UFC. The new publicly listed company that will combine the two entities will operate under the name TKO Group Holdings.

Outlook

Outside of a few major surprises, including the regional banking situation and an overly optimistic period of AI euphoria, it is perhaps surprising how little market risks and narratives have shifted over the last nine months. The two big uncertainties that many investors highlighted at the start of the year (i) whether inflation would persist and, (ii) whether there would be a recession, remain largely unresolved. While it is clear in the hard data that inflation has dropped over the course of the year, recent readings remain uncomfortably above the Federal Reserve’s target levels. Rapid increases in food and energy prices also persisted throughout the quarter fueling further uncertainty in the outlook. On the economy, the consensus view at the start of 2023 was that we were heading into a recession, with the only questions being when it would kick in, and how deep it would be. To this point, those questions still remain. One reason for market resiliency this year has been the performance of the economy, which has managed to not only avoid a recession to this point but also deliver strong employment numbers. Against this uncertain backdrop, the market may continue swinging between wild optimism, where inflation is no longer viewed as a threat and the economy has a soft landing, and extreme pessimism, where inflation comes roaring back, and the economy falls into a recession. Because of the difficulty in forecasting these macroeconomic outcomes, we have always strived to avoid making such predictions. Instead, we will – as always – stay focused on forecasting the underlying fundamentals of the companies in which we invest rather than making top-down investment or portfolio decisions. We do, however, believe that a normalization of financial conditions through higher rates (nominal and real) and QT should result in a more favorable market environment for quality companies with strong fundamentals better than it had been in the years leading up to, and through the pandemic/2021 period during which “Easy Money Policy” distorted market and style dynamics. Thus far in 2023, including the third quarter, we have seen short-term periods where more reasonably valued companies have recovered on a relative basis, but this has not been a linear shift in the market as much of the first half rally was more sentiment-driven than fundamentally supported, in our view. Ultimately, we believe business fundamentals and valuations are the key determinants of investment returns over extended periods and that remains our focus.

From an asset class perspective, valuations of small versus large continue to remain near multi-decade lows, which we believe suggests a more favorable setup for small caps relative to large caps in the periods to come (12.3x P/E for the Russell 2000 Index vs. 21.2x P/E for the Russell 1000 Index). Based upon relative P/E alone, there has been no other time in the Russell 2000’s history that has been as attractive relative to large cap as in recent times. Additionally, earnings and sales growth are expected to improve for small caps in 2024 and outpace that of large caps, which we believe provides further fundamental support and potential upside for the asset class. A peak in US large cap market concentration has also historically been followed by sustained small cap outperformance. Small caps are less vulnerable to a top-heavy market, helping reduce the index’s sensitivity to individual company performance. Moreover, small caps tend to outperform large caps when inflation falls from high levels as well as during recovery periods coming out of economic downturns. Investors thinking of positioning around these trends may benefit from moving down in market capitalization, in our opinion.

Positioning

As always, we remain focused on long-term business fundamentals, even in the face of elevated short-term volatility. Our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Overweights in Industrials and Information Technology are mostly a function of recent portfolio activity and the relative performance of our holdings in these sectors over the past few periods. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling long-term opportunities that fit our discipline given the rising risk profiles of many retail businesses and a potential deceleration in goods spending following a period of strength fueled in part by government backed stimulus payments. While the portfolio’s allocation to Health Care is modestly below that of the benchmark’s, we continue to remain underweight the Biotechnology industry as many companies within that group do not fit our discipline due to their elevated levels of binary risk. Given the rising levels of volatility and the apparent short-term disconnect between certain areas of the market and business fundamentals, we believe it is important to remain patient in identifying investment opportunities to ensure they offer a compelling risk-reward trade-off and a sufficient margin of safety. Furthermore, we remain focused on trying to understand the risks associated with each investment position within the context of our fundamentally oriented research process and managing those risks through a disciplined approach to portfolio construction and management.

The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice.

Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Effective January 1, 2022, the Russell 2000 Value Index was removed as the secondary benchmark for the Aristotle Capital Boston Small Cap Equity strategy.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs.

These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments.

The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass.

The firm’s coverage of Signature Bank includes time at a predecessor firm.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2310-17

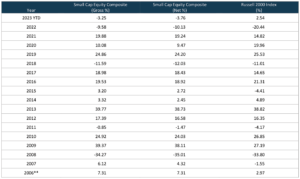

Sources: CAPS Composite Hub, Russell Investments

Composite returns for periods ended September 30, 2023 are preliminary pending final account reconciliation.

*The Aristotle Small Cap Equity Composite has an inception date of November 1, 2006 at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015 was achieved at Aristotle Boston.

**For the period November 2006 through December 2006.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Effective January 1, 2022, the Russell 2000 Value was removed as the secondary benchmark for the Aristotle Capital Boston Small Cap Equity strategy.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Please see important disclosures enclosed within this document.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Growth® Index measures the performance of the small cap companies located in the United States that also exhibit a growth probability. The Russell 2000 Value® Index measures the performance of the small cap companies located in the United States that also exhibit a value probability. The Russell 1000® Index measures the performance of the large cap segment of the U.S. equity universe. The Russell 1000 Index is a subset of the Russell 3000® Index, representing approximately 90% of the total market capitalization of that index. It includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices.