Commentary

Global Equity 1Q 2024

(All MSCI index returns are shown net and in U.S. dollars unless otherwise noted.)

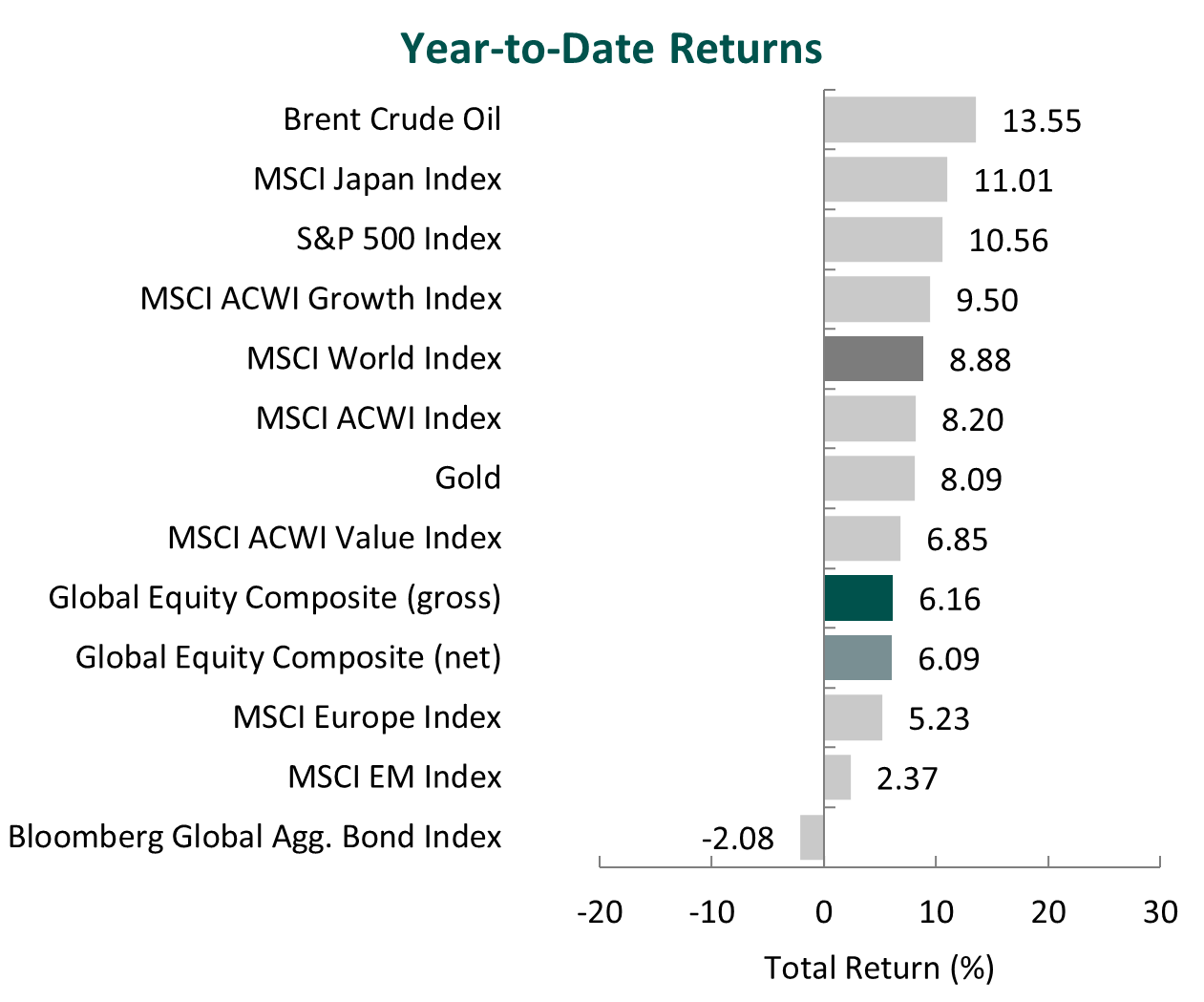

Markets Review

Sources: CAPS CompositeHubTM, Bloomberg

Past performance is not indicative of future results. Aristotle International Equity Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Capital Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Global equity markets continued to climb during the first quarter. Overall, the MSCI ACWI Index rose 8.20% during the period. Concurrently, the Bloomberg Global Aggregate Bond Index fell 2.08%. In terms of style, value stocks underperformed their growth counterparts during the quarter, with the MSCI ACWI Value Index trailing the MSCI ACWI Growth Index by 2.65%.

Japan and North America were the strongest regions, while Latin America and Asia/Pacific ex-Japan posted negative returns. On a sector basis, ten out of the eleven sectors within the MSCI ACWI Index finished in the green, with Information Technology, Communication Services and Energy increasing the most. Meanwhile, Real Estate was the only sector to decline, while Utilities and Materials gained the least.

Economic conditions varied by region, though most developed countries reported slowing inflation. For the month of February, both the U.K. and U.S. reported annual inflation descending toward the 3% mark, while the eurozone recorded an annual rate of 2.6%. As such, the respective central banks held monetary policy steady while signaling the possibility of rate cuts starting in June as the countries make progress toward the 2% target.

However, in Asia, Japan raised interest rates for the first time since 2007 to a range of 0.0% to 0.1%, as both inflation and wage growth have recently accelerated. This marked a historic shift and ended Japan’s period of negative rates, finally removing the world’s last remaining negative rates regime. Conversely, China lowered its five-year loan prime rate to bolster its faltering economy that is battling deflation and a troubled real estate sector.

In geopolitics, the conflict in the Middle East continued, with increased fighting in Lebanon and direct conflict in the Red Sea between the U.S. and Yemen’s Houthis, which have targeted more than two dozen ships traveling to and from the Suez Canal. The heightened activity in surrounding countries has sparked concerns of further regional escalation and the possibilty of a wider conflict. In Europe, Russia made small advances in Ukraine, including the capture of the city of Avdiivka, as Ukrainian troops struggle with supply shortages. The U.S. has recently partnered with countries such as South Korea and Turkey to provide additional ammunition and supplies to Ukraine.

Performance and Attribution Summary

For the first quarter of 2024, Aristotle Capital’s Global Equity Composite posted a total return of 6.16% gross of fees (6.09% net of fees), underperforming the MSCI World Index, which returned 8.88%, and the MSCI ACWI Index, which returned 8.20%. Please refer to the table below for detailed performance.

| Performance (%) | 1Q24 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception* |

|---|---|---|---|---|---|---|

| Global Equity Composite (gross) | 6.16 | 20.19 | 5.75 | 11.74 | 9.84 | 10.31 |

| Global Equity Composite (net) | 6.09 | 19.84 | 5.42 | 11.38 | 9.45 | 9.88 |

| MSCI World Index (net) | 8.88 | 25.11 | 8.60 | 12.06 | 9.39 | 10.05 |

| MSCI ACWI Index (net) | 8.20 | 23.22 | 6.95 | 10.90 | 8.65 | 9.09 |

Source: FactSet

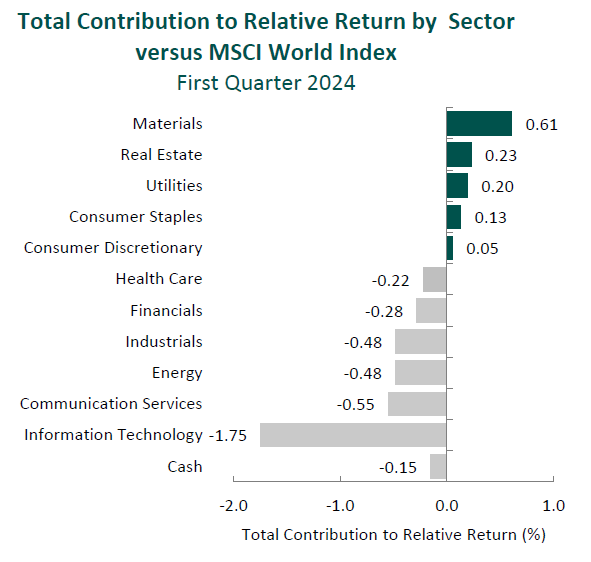

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income.

From a sector perspective, the portfolio’s underperformance relative to the MSCI World Index can be primarily attributed to security selection, while allocation effects also had a negative impact. Security selection in Information Technology, Industrials and Energy detracted the most from the portfolio’s relative performance. Conversely, security selection in Materials and a lack of exposure to Real Estate and Utilities contributed to relative return.

Regionally, both security selection and allocation effects were responsible for the portfolio’s underperformance relative to the MSCI World Index. Security selection in North America and Japan detracted the most from relative performance, while security selection in Europe and an overweight in Japan contributed.

Contributors and Detractors for 1Q 2024

| Relative Contributors | Relative Detractors |

|---|---|

| Martin Marietta Materials | Adobe |

| Lennar | AIA Group |

| Munich Reinsurance | Sony |

| FirstCash | Cameco |

| Qualcomm | Microchip Technology |

Adobe, the content creation and publishing software provider, was the leading detractor for the quarter.The company continues to benefit from its shift to a subscription model, with almost 95% of its record $19.4 billion in fiscal year 2023 revenue coming from subscriptions, while continuing to invest in innovation that expands its addressable market. Nevertheless, investors seem concerned with some of the lower-cost alternatives entering the market, including Sora, an OpenAI platform that produces videos from text. While much attention has also been placed on Adobe’s Firefly, a generative AI service that has already produced more than 6.5 billion images since launch in March 2023, we will take our time to understand Adobe’s AI monetization strategy. In the meantime, we continue to believe that the combination of Express, Firefly, Creative Cloud, Acrobat and Experience Cloud provides a unique solution to address all the content and data needs of clients and their management of the customer experience. In addition to innovation, Adobe continues to generate and return cash to shareholders, exemplified most recently by its new $25 billion stock repurchase program.

Sony, the global provider of videogames and consoles, image sensors, music and movies, was one of the largest detractors for the period. Sony cut its guidance from 25 million PlayStation 5 (PS5) units sold to 21 million units for the fiscal year. Despite the underwhelming hardware results, management has emphasized the importance of balancing profitability and sales in the latter stage of the PS5’s life cycle which it expects to achieve through engagement, with monthly active users reaching a record high of 123 million accounts. Furthermore, we will continue to monitor management’s ability to improve game development, streamline project management and control costs, as Sony has already begun to implement structural reforms in its Game & Network Services segment. In its Pictures segment, Sony terminated its merger with Zee Entertainment, as closing conditions were not met within the set two-year window. Nevertheless, management believes India remains a promising market and will proactively explore opportunities to bolster its position in the country. We remain confident in Sony’s ability to build on its industry leadership, and we feel the company’s continued optimization of business operations, including its plan for a partial spinoff of its Financial Services business, positions the company to enhance long-term value.

Aggregates producer Martin Marietta Materials was a top contributor for the period. As a result of the company’s successful execution of its value-over-volume commercial strategy, including 15% price increases in its aggregates business, Martin Marietta reported full-year records for revenues and profitability. Furthermore, the company continues to bolster its leadership position through the acquisitions of Albert Frei & Sons, a leading aggregates producer in Colorado, and the southeast aggregates operations of Blue Water Industries. These transactions are expected to add one billion tons of reserves, improve product mix and profitability, and allow for the expansion into new target markets such as Nashville and Miami. We believe Martin Marietta is well positioned to continue executing on its catalysts, including optimizing its product portfolio and further enhancing profitability from both pricing and operations initiatives, all while benefiting from continued increases in both non-residential construction and government spending.

Munich Re, the world’s largest reinsurance company, was a leading contributor for the quarter. The company reported strong results as it continues to win market share, leverage its global scale and demonstrate underwriting discipline. Perhaps counterintuitively, recent global crises, such as war in both the Middle East and Ukraine and natural disaster losses that topped $100 billion, as well as the impact of inflation, showcase Munich Re’s strengths. Through these crises, the company has, we believe, displayed its prudent risk-taking and global diversification. Moreover, Munich Re (and its peers) have benefited from industry-wide price increases, which have contributed to increased return of capital to shareholders. The company raised its dividend by nearly 30% in 2023 and announced a new €1.5 billion share buyback program. We continue to believe Munich Re is attractively positioned to gain market share in a variety of areas, including cybersecurity, specialty insurance and in the fast-growing economies in Asia where the market is large, but insurance penetration remains relatively low.

Recent Portfolio Activity

| Buys | Sells |

|---|---|

| None | None |

Consistent with our long-term horizon and low turnover, there were no new purchases or sales completed during the quarter.

Conclusion

Despite the U.S. economy’s continued expansion, economic data points remain mixed. Additionally, investors face uncertainty the rest of the year, whether it be the path of central bank policy, the outcome of the 2024 U.S. presidential election, or the potential for new and/or escalating geopolitical conflicts.

However, while our analysis considers long-term developments in the macroeconomy, we focus most of our time and attention on individual companies that, in our opinion, possess a combination of qualities that are sustainable and difficult to reproduce. It is our belief that a diversified portfolio of investments in these companies will thrive over full market cycles.

The opinions expressed herein are those of Aristotle Capital Management, LLC (Aristotle Capital) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to buy or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Capital makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle Global Equity strategy. Not every client’s account will have these characteristics. Aristotle Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Capital’s Global Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Capital does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Capital Management, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Capital, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACM-2404-75

Sources: CAPS CompositeHubTM, MSCI

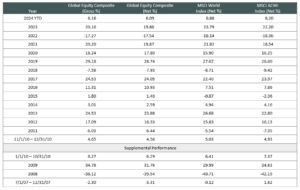

Composite returns for all periods ended March 31, 2024 are preliminary pending final account reconciliation.

The Aristotle Global Equity Composite has an inception date of November 1, 2010; however, the strategy initially began at Howard Gleicher’s predecessor firm in July 2007. A supplemental performance track record from January 1, 2008 through October 31, 2010 is provided on this page and complements the Global Equity Composite presentation that is located at the end of this presentation. The performance results were achieved while Mr. Gleicher managed the strategy at a prior firm. The returns are those of a publicly available mutual fund from the fund’s inception through Mr. Gleicher’s departure from the firm. During that time, Mr. Gleicher had primary responsibility for managing the fund.

Past performance is not indicative of future results. The information provided should not be considered financial advice or a recommendation to purchase or sell any particular security or product. Performance results for periods greater than one year have been annualized.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 24 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The MSCI ACWI captures large and mid-cap representation across 23 developed markets and 24 emerging markets countries. With approximately 3,000 constituents, the Index covers approximately 85% of the global investable equity opportunity set. The MSCI ACWI Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI Europe Index captures large and mid-cap representation across 15 developed markets countries in Europe. With more than 400 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization across the European developed markets equity universe. The MSCI Japan Index is designed to measure the performance of the large and mid-cap segments of the Japanese market. With approximately 250 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in Japan. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Bloomberg Global Aggregate Bond Index is a flagship measure of global investment grade debt from 28 local currency markets. This multi-currency benchmark includes Treasury, government-related, corporate and securitized fixed rate bonds from both developed and emerging markets issuers. The Brent Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. The volatility (beta) of the Composite may be greater or less than the benchmarks. It is not possible to invest directly in these indexes.