Morgan Stanley

Small/Mid Cap Equity 1Q 2022

ARISTOTLE CAPITAL BOSTON, LLC

FOR FINANCIAL ADVISORS ONLY. NOT FOR PUBLIC DISTRIBUTION.

Markets Review

After a strong 2021, small/mid cap equities declined alongside other risk assets to begin the year as investors grappled with a myriad of uncertainties, including a shift to tighter monetary policy, the impact of rampant inflation and the ripple effects from Russia’s invasion of Ukraine. On the policy front, the Federal Reserve (Fed) raised the target rate by 0.25%, as expected, making it clear that further increases will be appropriate. Fed officials will now focus on the challenging task of taming inflation without stunting economic growth and sending the U.S. economy into a recession. In related news, supply shortages fueled by the Ukraine-Russia conflict, along with a host of pre-existing factors, drove commodity prices higher during the period. Oil prices were particularly volatile, with crude oil at one point eclipsing $130 a barrel. Natural gas, fertilizer and agriculture-related commodity prices also experienced sharp increases during the period.

From a sector perspective, performance varied widely during the quarter, ranging from the 40.39% total return of the Russell 2500 Energy sector to the 15.16% decline of the Consumer Discretionary sector. To put this type of dispersion into context, Energy’s 40.39% gain versus Consumer Discretionary’s 15.16% loss marked the second largest divergence between any two Russell 2500 sectors in a single quarter. Only Information Technology’s outperformance of Utilities in the fourth quarter of 1999 was greater. Other areas of the small/mid cap market that were hit hard in the first quarter included Health Care (-14.94%) and Information Technology (-9.52%), while Materials (+6.76%) and Utilities (+2.49%) followed Energy as the only other sectors to close the quarter in positive territory.

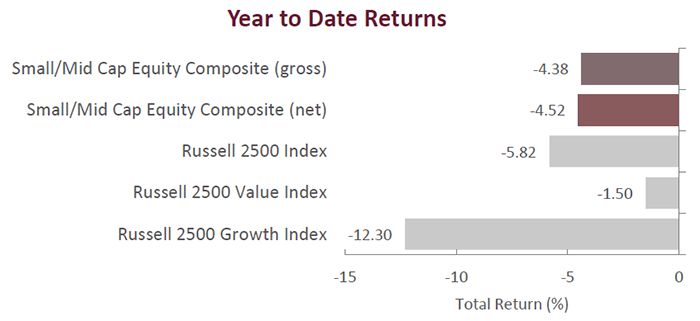

Stylistically, value continued its outperformance of growth in the first quarter, as evidenced by the Russell 2500 Value Index’s return of -1.50% compared to the -12.30% return of the Russell 2500 Growth Index. This marks the third consecutive quarter of outperformance for the Russell 2500 Value Index relative to the Russell 2500 Growth Index. Factor performance was decidedly mixed during the period, as companies with lower valuations and stronger profitability generally outperformed during the first half of the quarter before ceding leadership to more expensively valued securities during the second half of the quarter. On the other hand, March market performance was particularly bifurcated, as the final three weeks of the month saw pronounced outperformance from the meme stocks, bitcoin and other risk-on proxies, a complete reversal from the first two weeks of the month and factor leadership during the January period.

Sources: SS&C Advent; Russell Investments

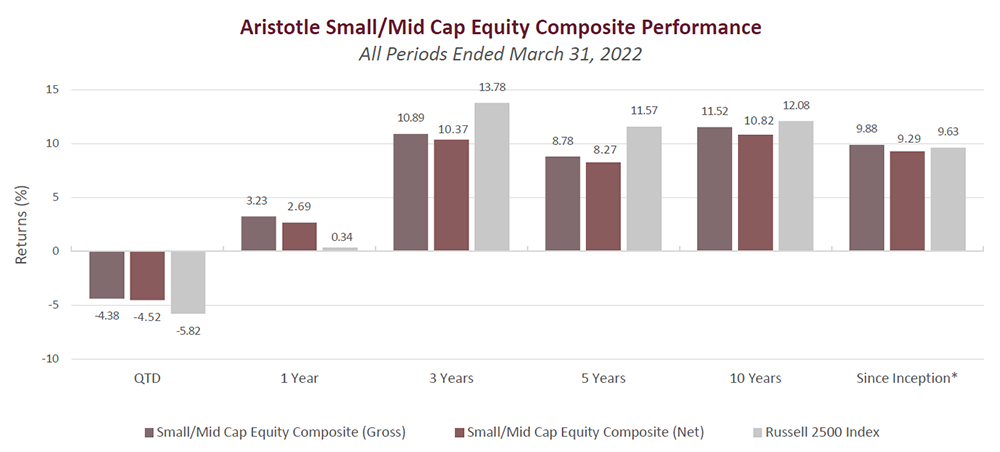

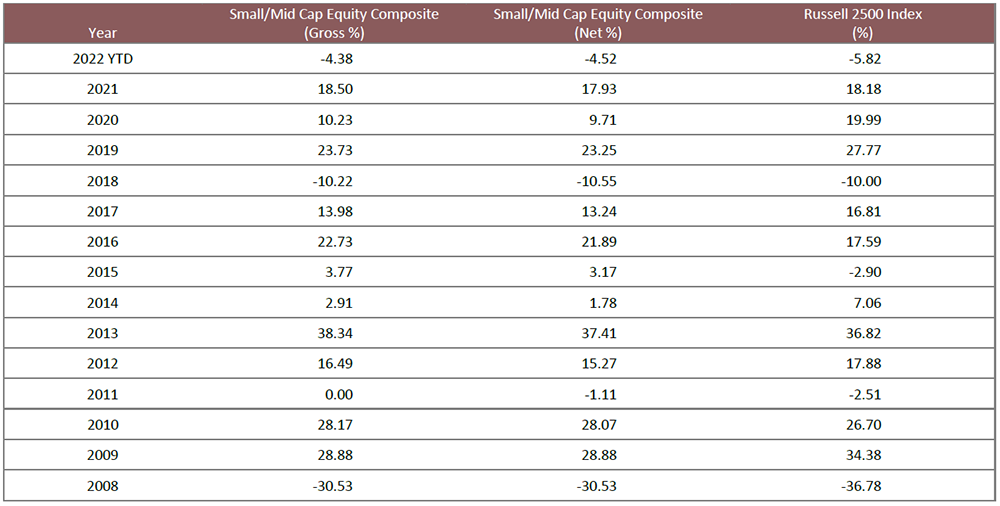

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Aristotle Boston Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Performance Review

For the first quarter of 2022, the Aristotle Small/Mid Cap Equity Composite generated a total return of -4.38% gross of fees (-4.52% net of fees), outperforming the -5.82% total return of the Russell 2500 Index. Outperformance during the quarter was driven entirely by security selection, while allocation effects modestly detracted. Overall, security selection within the Health Care, Energy and Information Technology sectors added the most value on a relative basis, while selection within Financials, Materials and Consumer Discretionary detracted. From an allocation perspective, the portfolio benefited from an underweight in Consumer Discretionary and an overweight in Financials; however, this was offset by an underweight in Energy and an overweight in Information Technology.

| Relative Contributors | Relative Detractors |

|---|---|

| Range Resources | MACOM Technology Solutions |

| NexTier Oilfield Solutions | AerCap Holdings |

| HealthEquity | Charles River Laboratories |

| Cal-Maine Foods | Harsco |

| KBR | 1-800-FLOWERS.COM |

CONTRIBUTORS

Security selection added the most value within the Health Care, Energy and Information Technology sectors. From an allocation perspective, an underweight in Consumer Discretionary and an overweight in Financials contributed positively to relative performance. At the company level, Range Resources and NexTier Oilfield Solutions were two of the largest contributors during the quarter.

- Range Resources (RRC), a natural gas focused exploration and production company with operations in the Appalachian Basin, appreciated due to improved investor sentiment following an uptick in natural gas pricing. We maintain a position, as we believe the company’s low-cost acreage allows it to translate the healthy price environment into earnings and cash flow that is being used to reduce financial leverage, which can accrue additional value to equity shareholders in periods to come.

- NextTier Oilfield Solutions (NEX), a provider of hydraulic fracturing and other completion-oriented oilfield services to exploration and production companies in the U.S., benefited from rising U.S. completion activity and rising prices due to tight supply/demand fundamentals for frac equipment. We maintain a position, as we believe the company’s dedicated service agreements, solid execution and merger synergies from recent mergers and acquisitions activity can unlock additional value for shareholders in periods to come.

DETRACTORS

Security selection detracted within the Financials, Materials and Consumer Discretionary sectors. Additionally, the portfolio’s underweight in Energy and overweight in Information Technology detracted from relative performance. At the company level, MACOM Technology Solutions and AerCap Holdings were two of the largest detractors during the quarter.

- MACOM Technology Solutions (MTSI), a designer and manufacturer of high-performance semiconductors, declined in the face of industry-wide supply chain issues. Nevertheless, the company’s fundamentals continue to advance, as we believe the company’s meaningful exposure to growing demand from Data Center and 5G end market applications plus solid company-specific execution has driven faster-than-expected profitability. We believe the underlying demand drivers are sustainable for the foreseeable future and continue to maintain our position.

- AerCap Holdings (AER), the world’s largest aircraft leasing firm, declined due to negative sentiment associated with the business given its exposure to the airline industry and the recovery of certain eastern European assets. We maintain a position, as we believe the company is well-positioned to weather this period of volatility given its competitive position, robust pipeline of new aircraft orders and strong balance sheet.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| AZEK | Evercore |

| iStar | Kraton |

| Jacobs Engineering Group | |

| Sonos |

BUYS/ACQUISITIONS

- AZEK (AZEK), a leading manufacturer of residential building products, primarily focused on wood-alternative decking, railing and trim, was added to the portfolio. We believe the strong secular demand backdrop for alternative, sustainably sourced building products along with company-specific margin improvements should benefit shareholders in periods to come.

- iStar (STAR), an internally-managed real estate investment trust specializing in ground leases through its ownership of 65% of Safehold Inc. (SAFE), was added the to the portfolio. We believe the recent sale of the company’s net-lease asset portfolio will allow management to focus on continued investments in its SAFE ground lease business and also paves the way for management to acquire the remaining portion of SAFE that it does not already own.

- Jacobs Engineering Group (J) is a professional services firm focused on engineering and government services that is in the early stages of transforming its business strategy by divesting several capital-intensive cyclical businesses in favor of asset-light engineering and consulting businesses. We believe the company is now well-positioned to benefit from several attractive secular trends, including environmental, defense and intelligence spending by government and business customers.

- Sonos (SONO), a consumer electronics company with proprietary multi-room smart speaker technology, was added to the portfolio on the belief that strong consumer demand for the company’s differentiated product offering plus a multi-year pipeline of upcoming new product introductions are expected to drive shareholder value for the next several years.

SELLS/LIQUIDATIONS

- Evercore (EVR), a boutique investment bank that provides advisory and wealth management services, was removed from the portfolio due to our belief that shares were fully valued and we were nearing a cyclical peak in demand for the company’s services.

- Kraton Corporation (KRA), a chemical company that manufactures and sells specialty polymers to various end markets, was removed from the portfolio by virtue of its acquisition by DL Chemical.

Outlook and Positioning

Despite the pickup in volatility over the first few months of 2022, we continue to believe that generally positive fundamentals and low relative valuations support further upside for small/mid cap equities. While near-term price movements and volatility continue to be driven by macroeconomic and geopolitical issues in the short term, we believe business fundamentals will ultimately determine equity values in the long run. Additionally, as the Fed continues its path toward interest rate normalization, and as company fundamentals and valuations become increasingly more important, we believe this development should be beneficial for fundamentally-oriented, active managers like ourselves. As such, we remain optimistic about the prospects for small/mid cap equities going forward, given our views on the overall fundamentals of our individual holdings at this stage in the market cycle. While economic growth may slow globally and even domestically, we continue to believe the U.S. economy is on relatively healthier footing than other markets around the world, which should benefit the more domestically-oriented small/mid cap market. Small/mid caps, which derive the vast majority of their revenues from U.S. sources, may also be less impacted by continued geopolitical turmoil abroad relative to large caps. With that said, we recognize there are certain areas of the market that continue to appear to be stretched in terms of balance sheet quality and valuations, and the small/mid cap market continues to have a high percentage of negative earning companies (roughly one-fifth of constituents). We believe these later cycle conditions, along with the heightened periods of market volatility, favor quality-oriented investors like ourselves and can provide us with additional opportunities to add value on an absolute and relative basis.

Our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Recent purchases have been spread across industries and are idiosyncratic in nature, as opposed to being tied to an outlook for a particular sector. Overweights in Industrials and Information Technology are mostly a function of the performance of our holdings in these sectors over the past few years. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling opportunities that fit our discipline given the rising risk profiles as a result of structural headwinds for various brick and mortar businesses. We also continue to be underweight in Real Estate as a result of valuations and structural challenges for various end markets within the sector. Given our focus on long-term business fundamentals, patient investment approach and low portfolio turnover, the strategy’s sector positioning generally does not change significantly from quarter to quarter; however, we may take advantage of periods of volatility by adding selectively to certain companies when appropriate. As always, our focus remains on identifying what we view as attractive, long-term investment opportunities that can create value for shareholders over the next three to five years, which we believe gives us the best opportunity to generate alpha for our clients.

The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice. Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small/Mid Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. For example, a 0.5% annual fee deducted quarterly (0.125%) from an account with a ten-year annualized growth rate of 5.0% will produce a net result of 4.4%. Actual performance results will vary from this example.

The Russell 2500 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2500 Growth® Index measures the performance of the small/mid cap companies located in the United States that also exhibit a growth probability. The Russell 2500 Value® Index measures the performance of the small/mid cap companies located in the United States that also exhibit a value probability. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices.

This presentation is to report on the investment strategies as reported by Aristotle Capital Management, LLC and is for illustrative purposes only. The information contained herein is obtained from multiple sources and believed to be reliable. Information has not been verified by Morgan Stanley Wealth Management, and may differ from documents created by Morgan Stanley Wealth Management. The financial advisor should refer to the Profile. This must be preceded or accompanied by the Morgan Stanley Wealth Management Profile, which you can obtain from the Morgan Stanley Wealth Management Performance Analytics. For additional information on other programs, please speak to Patrick Schussman at Aristotle Capital at (310) 954-8156.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2204-21-MSFA

Sources: SS&C Advent, Russell Investments

Composite returns for periods ended March 31, 2022 are preliminary pending final account reconciliation.

*The Aristotle Small/Mid Cap Equity Composite has an inception date of January 1, 2008 at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015 was achieved at Aristotle Boston.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Please see important disclosures enclosed within this document.