Commentary

Small Cap Equity 4Q 2022

ARISTOTLE CAPITAL BOSTON, LLC

Markets Review

Sources: SS&C Advent; Russell Investments

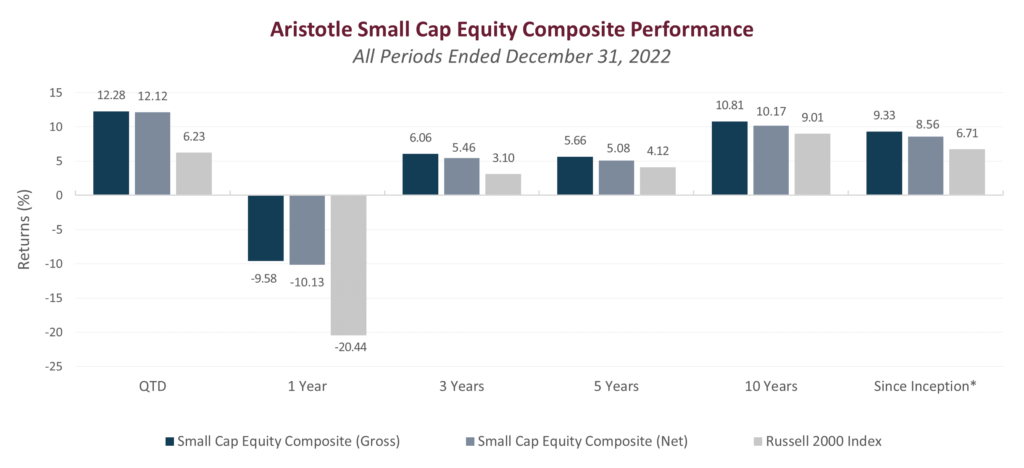

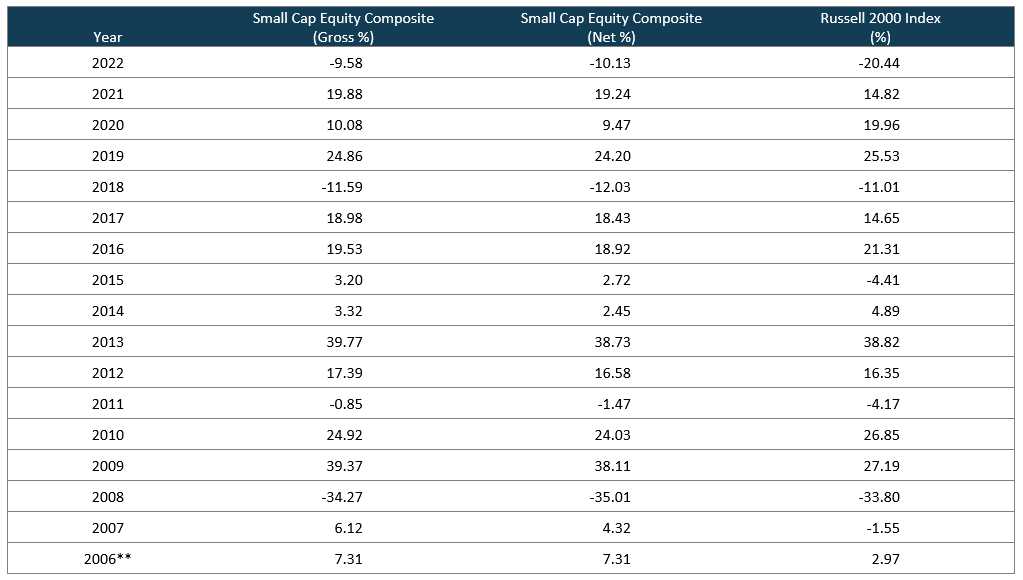

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Small Cap Equity Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

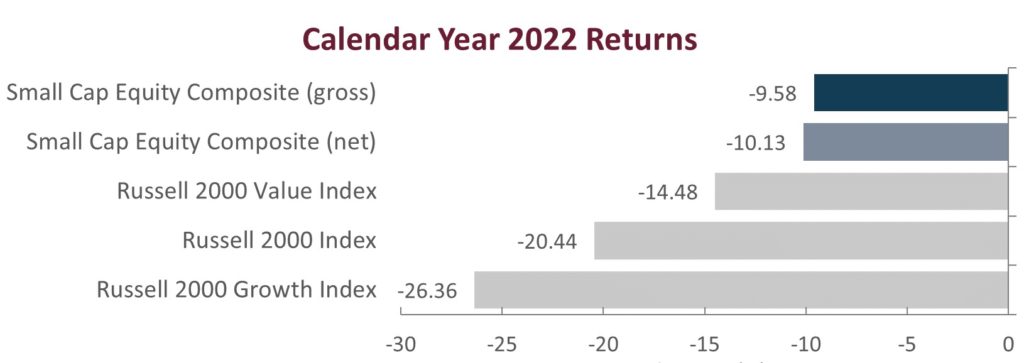

Small caps ended the year on a positive note, with the Russell 2000 Index rising 6.23% during the final quarter of the year. Despite some relief in the fourth quarter, 2022 will mainly be remembered as a year when markets priced in the unpleasant consequences of higher inflation and interest rates, which many expect to hit the global economy in 2023. To that end, inflation remained elevated in the U.S., with the Consumer Price Index (CPI) rising 7.1% for the 12-month period ending in November, continuing to slow from the 40-year highs of 9.1% set in June. While some economic indicators are suggesting that an economic slowdown lies ahead, third quarter U.S. Gross Domestic Product (GDP) was revised higher during the period, increasing 3.2%, and rebounding from two consecutive quarters of contraction. In response to the economic and inflationary backdrop, the Federal Reserve (Fed) raised its policy rate by 50 basis points at its December meeting, providing somewhat of a reprieve relative to the prior four 75 basis points increases. Still, this represented the fastest increase in rates since 1970 and a total increase of 4.25% in 2022. Against this backdrop, small caps declined 20.44% for the full calendar year, ending a three-year run of positive returns for the broad Russell 2000 Index.

Stylistically, the Russell 2000 Value Index was a relative outperformer throughout 2022, with a full year return of -14.48% versus the -26.36% return of the Russell 2000 Growth Index. This marks the second consecutive calendar year where value has led the small cap market and the first time that value has outperformed growth in two consecutive years since 2005-2006. Likewise, cash flow generation and profitability remained in favor throughout the year after taking a multi-year back seat to anticipated revenue growth in the hierarchy of small cap investor preferences. This is highlighted by the performance differential between money-losing and profitable companies in recent periods. For the full year, unprofitable* companies within the Russell 2000 Index returned -37.18%, while those with positive earnings declined “only” -15.66% on average.

At the sector level, ten of the eleven economic sectors within the Russell 2000 Index generated positive returns during the quarter led by Energy, Materials and Industrials. Health Care was the only sector to generate a negative return, while Communication Services and Information Technology also lagged. For the full year, Energy was by far the best performing sector within the index and the only sector to generate a positive return. Defensives Utilities and Consumer Staples were the next best performing sectors, finishing the year with modest declines. Communication Services, Information Technology and Consumer Discretionary were the worst performing sectors for the year, all producing declines in excess of -30%.

*Based on earnings expectations over the next twelve months. Source: FactSet

Performance Review

For the fourth quarter of 2022, the Aristotle Small Cap Equity Composite posted a total return of 12.12% net of fees (12.28% gross of fees), outperforming the 6.23% total return of the Russell 2000 Index. Outperformance was driven entirely by security selection during the quarter. Overall, security selection was strongest within the Health Care and Information Technology sectors and weakest in Financials and Consumer Discretionary. From an allocation perspective, the portfolio benefited from an overweight in Industrials and an underweight in Communication Services. This was partially offset by an underweight in Energy and Materials. For the full calendar year, the Aristotle Small Cap Equity Composite generated a total return of -10.13 net of fees (-9.58% gross of fees), outperforming the -20.44% return of the Russell 2000 Index.

| Relative Contributors | Relative Detractors |

|---|---|

| Ardmore Shipping | Designer Brands |

| Altra Industrial Motion | Viad |

| Oceaneering | ASGN |

| AerCap Holdings | ModivCare |

| Merit Medical Systems | Signature Bank |

CONTRIBUTORS

Ardmore Shipping (ASC), a product and chemical transportation company focused on modern mid-sized “eco-friendly” vessels, appreciated following record third quarter earnings driven by supportive industry supply-demand fundamentals, higher spot rates and longer voyages. We maintain a position, as we believe the company continues to operate from a position of strength, driven by recent shareholder friendly capital allocation decisions, strong operating performance and a favorable industry supply-demand backdrop.

Altra Industrial Motion (AIMC), a global manufacturer and supplier of motion control, power transmission and automation products, appreciated following an announcement that the company would be acquired by Regal Rexnord Corporation. The merger is expected to close in the first half of 2023 and upon the completion of the transaction, Altra shares will no longer be listed in the public market.

DETRACTORS

Designer Brands (DBI), a designer, producer and retailer of footwear and accessories, declined in the face of broad consumer weakness and a downwardly revised forward outlook. We maintain a position, as we believe the company is well-positioned to benefit from the continued growth of its in-house brands and direct-to-consumer channels, along with in-store strategic initiatives.

Viad (VVI), a provider of high-quality, experience-based services for the hospitality and live events industries, declined amid a slower than expected recovery in long-haul international travel and an unfortunate disruption of company operations due to wildfires near some of the company’s hotels and attractions. We maintain our investment, as we believe the company’s growing service offering, expanded marketing platform and a recovery in international leisure travel and live events can drive shareholder value creation over the next several years.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| Adeia | Cal-Maine Foods |

| Enhabit | Xperi Holding |

| Safehold |

BUYS/ACQUISITIONS

Adeia (ADEA), is an intellectual property (IP) licensing business, focused on the media and semiconductor end markets. We inherited shares of Adeia via a spinoff from existing holding Xperi Holdings during the quarter. We maintain our investment in the company, as we assess the risk-reward profile of the standalone business.

Enhabit (EHAB), a provider of home health and hospice services, was added to the portfolio following its recent spinoff from Encompass Health. We initiated a position, as we believe the company should benefit from favorable demographic tailwinds, an advantageous geographic exposure and an accelerated migration of care to the home-setting, which should increase demand for the company’s services.

Safehold (SAFE), is a real estate investment trust (REIT) focused on acquiring, owning, managing and capitalizing ground leases. We inherited shares of Safehold via a special dividend from existing holding iStar, which holds a meaningful stake in Safehold. We maintain our shares ahead of the anticipated business combination between the two entities, which will create the only self-managed, pure-play ground lease company in the public markets.

SELLS/LIQUIDATIONS

Cal-Maine Foods (CALM), the largest producer and distributor of fresh shell eggs in the U.S., was removed from the portfolio based on our belief that shares were fully valued amid a favorable pricing environment, in part, driven by the supply related impact of the ongoing Avian Flu outbreak. While we continue to believe that Cal-Maine is a high-quality company, we are cognizant of the risk that egg prices may eventually return to a normalized level and prefer to step aside while we monitor the company’s progress from the sidelines.

Xperi Holding (XPER), a developer of technology for entertainment and consumer electronics products, was removed from the portfolio following its recent business reorganization, which resulted in the separation of the company’s product business, Xperi, and the company’s IP licensing business, Adeia.

Outlook and Positioning

2022 was a year to forget for investors, as markets grappled with a myriad of challenges that resulted in the worst calendar year decline for the Russell 2000 Index since 2008. Whether or not the market can rebound and produce a positive total return in 2023 will likely depend on many of the same factors that have influenced corporate profits and investor sentiment in 2022, including the timing and magnitude of future rate moves in response to inflation expectations, the seemingly never-ending geopolitical uncertainty around the world, changes to business and consumer spending patterns and commodity price movements, among others. The risks associated with these and other currently unknown issues may continue to impact global economic activity and thus equity market returns. However, the reality is that we do not know if, when or where these risks might be realized, so it is difficult to manage portfolios for specific threats that may or may not occur. Therefore, we remain focused on understanding the risk associated with each investment position within the context of our fundamentally-oriented approach and managing that risk through a disciplined approach to portfolio construction and management. As we have previously stated, we believe the current market environment reinforces the need for selectivity and further argues for a focus on companies with quality characteristics, particularly strong balance sheets and healthy profitability to offer a buffer in the face of adverse economic conditions.

On the plus side, given the recent declines and well-documented economic and corporate challenges on investors’ minds, we believe at least some of this risk may be priced into markets already, particularly within the small cap segment. At 12x, the Russell 2000 Index’s forward P/E is trading at its lowest levels in over 30 years, in-line with lows during the Great Financial Crisis and below the COVID-19 recession and 2001 recession lows. The relative P/E of the Russell 2000 Index versus the Russell 1000 Index also remains near historic lows and sits at its cheapest levels since the Dot-com bubble. For long-term investors, these valuations may imply a more favorable setup for small caps relative to large caps in the periods to come. Additionally, the 2020s may mark the beginning of deglobalization, where re-shoring of U.S. manufacturing accelerates following the pandemic and accompanying supply chain disruptions, trade tensions and geopolitical conflict. U.S. reshoring efforts, along with the accompanying need for regional banking, warehousing, etc., could result in a tailwind for small caps, whose sales are more highly correlated with U.S. CapEx cycles than large caps. Lastly, using history as a guide, we observe that calendar year declines of this magnitude, typically portend positive returns in the following year, with the Russell 2000 only having experienced two negative years in a row once since its inception. High and falling inflationary environments have also been favorable market environments for small caps historically, a scenario we may find ourselves in this year.

As always, our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Recent purchases and sales have been spread across industries and are idiosyncratic in nature, as opposed to being tied to an outlook for a particular sector. Overweights in Industrials and Information Technology are mostly a function of recent portfolio activity and the relative performance of our holdings in these sectors over the past few periods. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling long-term opportunities that fit our discipline given the rising risk profiles as a result of structural headwinds for various brick and mortar businesses. We also continue to be underweight in Real Estate as a result of valuations and structural challenges for various end markets within the sector. Given our focus on long-term business fundamentals, patient investment approach and low portfolio turnover, the strategy’s sector positioning generally does not change significantly from quarter to quarter. However, we may take advantage of periods of volatility by adding selectively to certain companies when appropriate.

Disclosures

The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice.

Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Effective January 1, 2022, the Russell 2000 Value Index was removed as the secondary benchmark for the Aristotle Capital Boston Small Cap Equity strategy.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs.

These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments.

The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request.

Performance Disclosures

Sources: SS&C Advent, Russell Investments

Composite returns for periods ended December 31, 2022 are preliminary pending final account reconciliation.

*The Aristotle Small Cap Equity Composite has an inception date of November 1, 2006 at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015 was achieved at Aristotle Boston.

**For the period November 2006 through December 2006.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Effective January 1, 2022, the Russell 2000 Value Index was removed as the secondary benchmark for the Aristotle Capital Boston Small Cap Equity strategy.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2301-16

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Growth® Index measures the performance of the small cap companies located in the United States that also exhibit a growth probability. The Russell 2000 Value® Index measures the performance of the small cap companies located in the United States that also exhibit a value probability. The Russell 1000® Index measures the performance of the large cap segment of the U.S. equity universe. The Russell 1000 Index is a subset of the Russell 3000® Index, representing approximately 90% of the total market capitalization of that index. It includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices.