Commentary

Small Cap Equity 2Q 2024

ARISTOTLE CAPITAL BOSTON, LLC

Markets Review

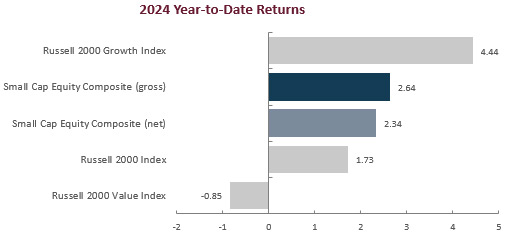

Small caps gave back some of their first quarter gains with the Russell 2000 index delivering a total return of -3.28%. Potential slowing in the US economy weighed on investor sentiment but lent credence to a soft landing scenario in 2024. The Consumer Price Index (CPI) drifted lower during the quarter, coming in below expectations at 3.0% as inflationary pressures have eased. Employment was muddled during the period as non-farm payroll growth was positive but volatile while unemployment steadily climbed to 4.1%. Despite softening data, the Federal Reserve (Fed) held its ground on easing at its June meeting, forecasting only one Fed funds rate cut in 2024, down from 3 cuts from its March meeting. The U.S. Treasury yield curve steepened with the yield on the 10-year note rising 16 basis points (bps) to end June at 4.36%.

Stylistically, growth stocks outperformed their value counterparts during the quarter as evidenced by the Russell 2000 Growth Index returning -2.92% compared to -3.64% for the Russell 2000 Value Index. There were three sectors that posted a positive absolute return in the growth index while all sectors in the value index were negative. Two of the largest names in the growth index for the first quarter, Super Micro and MicroStrategy, were the worst performers in the second quarter. Whether the underperformance was a function of decreasing AI enthusiasm or selling in advance of the two companies graduating to the larger Russell 1000 Index, it’s fair to say that the concentration and performance impact from both companies will be discussed by active small cap managers and academics for years to come. Pockets of exuberance can still be seen in the small cap universe as noted by the fact that Carvana, a volatile used car selling platform that had completed a distressed debt exchange in the fall of 2023, was the top contributor in the Russell 2000 Value Index as well as a top contributor in the Growth Index.

At the sector level, only two of the eleven sectors in the Russell 2000 Index recorded positive returns during the second quarter, led by the Consumer Staples (+2.28%), Utilities (+0.13%), and Communication Services (-0.63%) sectors. Conversely, Consumer Discretionary (-5.99%), Industrials (-4.41%), and Health Care (-4.29%) all lagged. Looking at market factors, profitable companies outperformed loss makers by nearly 200 bps during the quarter.

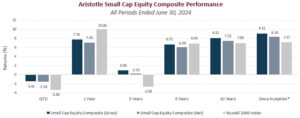

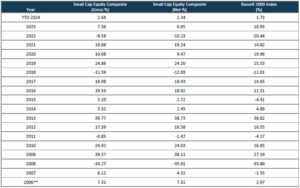

Sources: CAPS Composite Hub, Russell Investments

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Small Cap Equity Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Performance Review

For the second quarter of 2024, the Aristotle Small Cap Equity Composite posted a total return of -1.56% net of fees (-1.41% gross of fees), outperforming the -3.28% total return of the Russell 2000 Index. Outperformance was primarily driven by security selection while allocation effects also contributed. Overall, security selection was strongest within the Information Technology, Energy, and Financials sectors and weakest in Consumer Discretionary, Health Care, and Materials. From an allocation perspective, the portfolio benefitted from an underweight in Consumer Discretionary and an overweight in Information Technology, however, this was partially offset by an overweight in Industrials and an underweight in Financials.

| Relative Contributors | Relative Detractors |

|---|---|

| Ardmore Shipping | Carter’s |

| Dycom Industries | Cerence |

| Baldwin Insurance Group | Acadia Healthcare |

| TKO Group Holdings | Charles River Laboratories |

| Benchmark Electronics | The AZEK Company |

CONTRIBUTORS

Ardmore Shipping (ASC), a product and chemical transportation company focused on modern mid-sized vessels, appreciated amid global refinery shifts and geopolitical factors, boosted voyage lengths and demand for product tankers. We maintain a position, as we believe the company continues to operate from a position of strength, driven by recent shareholder-friendly capital allocation decisions, strong operating performance, and a favorable industry supply-demand backdrop.

Dycom Industries (DY), a provider of engineering and construction services to the telecommunications and cable television industries, benefitted from continued growth in its core business, funding tailwinds, and expanding margins as demand for wireline services continues to grow. We maintain a position as we believe the company remains well positioned for longer-term growth alongside secular trends for expanding fiber deployments to support faster broadband connectivity speeds and opportunities to deploy fiber to rural or underserved areas across the country.

DETRACTORS

Carter’s (CRI), a leading marketer of baby and young children’s apparel in North America, declined amid a cautious consumer spending environment and weak direct-to-consumer trends for the business during the quarter. We maintain our position as we believe the company has a strong brand in a stable category and that store rationalization efforts and an improving demographic backdrop can drive a sales recovery in the business in periods to come.

Cerence (CRNC), a developer of voice-connected technology for the transportation market, declined after guiding down the full-year revenue forecast along with the CFO’s departure. As discussed later, the investment team decided to sell the full position during the quarter.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| Chart Industries | AZZ |

| Littelfuse | Cerence |

| PowerSchool |

BUYS/ACQUISITIONS

Chart Industries (GTLS), an industrial equipment manufacturer that provides cryogenic equipment for storage, distribution, and other processes within the industrial gas and LNG, hydrogen, helium, carbon capture and water treatment industries was added to the portfolio. Strong forward demand for LNG and accelerating hydrogen opportunities coupled with company-specific improvement initiatives should benefit the company moving forward.

Littelfuse (LFUS), a designer and manufacturer of circuit protection, power control, and sensing products for the automotive, industrial, medical, and consumer end markets, was added to the portfolio. We believe the company’s dominant position in circuit protection and growing presence in automotive sensors and power semiconductors/components should benefit from ongoing efforts to solve power control and connection problems between the digital and physical worlds.

SELLS/LIQUIDATIONS

AZZ (AZZ), a provider of hot dip galvanizing and coil coating solutions, was sold during the quarter as the company’s stock price appreciated significantly since our initial purchase causing the reward to risk ratio to compress.

Cerence (CRNC), a provider of speech recognition and voice technologies for automotive applications was sold as the company embarked on a strategic shift to capitalize on the AI opportunity disrupting the financial progress we were anticipating.

PowerSchool (PWSC), a leading provider of cloud-based software for K-12 education in North America, was removed from the portfolio following the announcement the company was being taken private by investment firm Bain Capital.

Outlook

We continue to remain optimistic about the long-term potential for the small-cap segment of the U.S. market as valuations and potential tailwinds bode well for the asset class. As we look out to the second half of 2024, we are cautiously constructive as encouraging signs of economic stability are balanced by now consensus expectations of a soft landing scenario and the pricing of risk. So, despite greater clarity over the Fed’s path from here, there remains a long list of items creating uncertainty that could lead to greater volatility in 2024 including, but not limited to, signs that inflationary pressures have not yet fully dissipated, geopolitical tensions, U.S. equity index concentration issues, ongoing commercial real estate and regional banking concerns, and the looming presidential election. We are well aware that most of these issues are well known, but the timing and magnitude of the impact of any and all of these issues remains unpredictable. Therefore, as we always have, we will continue to avoid the temptation to forecast their outcome in favor of assessing the potential impact from a range of potential outcomes within our company‐specific, bottom-up analysis, and quality focus.

From an asset class perspective, valuations of small versus large continue to remain near multi-decade lows, which we believe suggests a more favorable setup for small caps relative to large caps in the periods to come (15.6x P/E for the Russell 2000 Index vs. 24.8x P/E for the Russell 1000 Index). Against a backdrop of moderating inflation, normalized interest rates, and a still growing U.S. economy, it looks to us that small-cap’s stretch of underperformance has the potential to end. If the economy continues to stabilize, our view is that valuations are likely to rise for those businesses that have largely sat out the mega-cap performance regime. It also helps that the well-noted concentration in large caps is reaching 50-year highs and small cap valuation relative to large cap is at multi-decade lows, therefore any fundamentally driven repositioning is likely to benefit small caps more than larger companies, in our view. Lastly, we believe smaller caps remain better positioned to benefit from the reshoring of U.S. manufacturing, a pickup in M&A activity, the CHIPS Act, and several infrastructure projects on the horizon.

Positioning

Our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Overweights in Industrials and Information Technology are mostly a function of our underlying company specific views rather than any top-down predictions for each sector. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling long-term opportunities that fit our discipline given the rising risk profiles of many retail businesses and a potential deceleration in goods spending following a period of strength. While the portfolio’s allocation to Health Care is modestly below that of the benchmark, we continue to remain underweight the Biotechnology industry as many companies within that group do not fit our discipline due to their elevated levels of binary risk. Given our focus on long-term business fundamentals, patient investment approach and low portfolio turnover, the strategy’s sector positioning generally does not change significantly from quarter to quarter. However, we may take advantage of periods of volatility by adding selectively to certain companies when appropriate.

The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice.

Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs.

These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments.

The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2407-11

Sources: CAPS Composite Hub, Russell Investments

Composite returns for periods ended June 30, 2024, are preliminary pending final account reconciliation.

*The Aristotle Small Cap Equity Composite has an inception date of November 1, 2006 at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015 was achieved at Aristotle Boston.

**For the period November 2006 through December 2006.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Please see important disclosures enclosed within this document.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Growth® Index measures the performance of the small cap companies located in the United States that also exhibit a growth probability. The Russell 2000 Value® Index measures the performance of the small cap companies located in the United States that also exhibit a value probability. The Russell 1000® Index measures the performance of the large cap segment of the U.S. equity universe. The Russell 1000 Index is a subset of the Russell 3000® Index, representing approximately 90% of the total market capitalization of that index. It includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.