Commentary

Small Cap Equity 4Q 2024

ARISTOTLE CAPITAL BOSTON, LLC

Markets Review

The volatility observed throughout 2024, continued into the fourth quarter. The Russell 2000 Index posted a modest gain of 0.33% for the quarter, bringing its year-to-date total return to 11.54%. After a sluggish start to the quarter, November was a standout month for small cap stocks following the U.S. elections, as the Russell 2000 Index rallied 10.97% driven by expectations of pro-business policies under the incoming Trump administration. However, these gains were largely erased in December, as the Index declined -8.26%, reflecting renewed concerns over geopolitical tensions and uncertainty around the incoming administration’s policies, such as tariffs and immigration, as well as the impact of sharply higher U.S. yields. Furthermore, continued strong economic growth, a stable labor market and firmer inflation data all pushed the Federal Reserve (Fed) in a more hawkish direction in December. After consecutive 25 basis point rate cuts at the November and December meetings, Chairman Powell indicated the Fed is likely to take a more measured approach going forward and the committee updated their projections to forecast only two rate cuts in 2025.

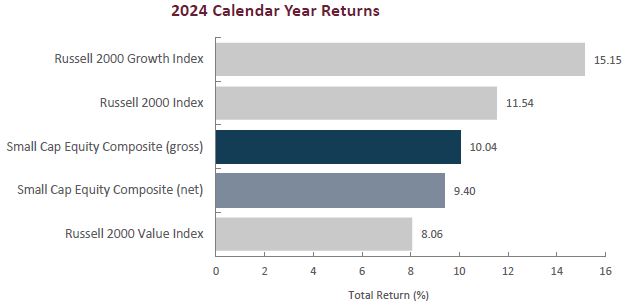

Stylistically, value stocks underperformed their growth counterparts during the quarter as the Russell 2000 Value Index returned -1.06% compared to the 1.70% return of the Russell 2000 Growth index. This widened the gap between value and growth for the year, as the Russell 2000 Growth Index gained 15.15% versus the 8.06% return for the Russell 2000 Value Index.

From a factor performance perspective, the quarter saw continued market preference for higher-growth companies, supported by declining interest rates and improving sentiment. Non-earners outperformed profitable companies by 325bps and the factors that led the way were highest forward sales growth, lowest share price, highest short interest, highest momentum, and lowest ROIC.

At the sector level, five of the eleven sectors in the Russell 2000 Index recorded positive returns during the quarter, led by Information Technology (+9.69%), Consumer Staples (+5.62%) and Industrials (+4.05%). Conversely, Health Care (-7.58%), Real Estate (-5.97%) and Materials (-4.69%) all underperformed. For the full year, ten of the eleven sectors contributed to performance, led by Information Technology (+25.20), Consumer Staples (+24.56), and Industrials (+17.69). Energy (-3.07) was the lone sector to finish in negative territory, while Health Care (+1.65) and Materials (+2.50) lagged in positive territory.

Sources: CAPS Composite Hub, Russell Investments

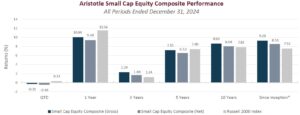

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Small Cap Equity Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Performance Review

For the fourth quarter of 2024, the Aristotle Small Cap Equity Composite posted a total return of -0.46% net of fees (-0.31% gross of fees), trailing the 0.33% total return of the Russell 2000 Index. Underperformance was driven by security selection. Overall, security selection in the Information Technology, Energy and Financials sectors detracted. This was partially offset by strong selection in the Health Care, Materials and Communication Services sectors coupled with an overweight allocation to the Information Technology sector and an underweight allocation to the Health Care sector.

| Relative Contributors | Relative Detractors |

|---|---|

| Chart Industries | Acadia Healthcare |

| Summit Materials | Ardmore Shipping |

| MACOM Technology Solutions | KB Home |

| Huron Consulting Group | HA Sustainable Infrastructure Capital |

| Liquidity Services | Dycom Industries |

CONTRIBUTORS

Chart Industries (GTLS), a company specializing in the design and manufacturing of highly engineered equipment for the industrial gas, energy, and biomedical industries, reported record high orders, a substantial increase in sales, and a strong backlog, driven by surging demand for its cryogenic equipment used in the clean energy sector, coupled with a changing positive sentiment around LNG by the new administration.

Summit Materials (SUM), a North American supplier of aggregates, cement, and ready-mix concrete for the construction industry, announced in November a definitive agreement to be acquired by Quikrete Holdings, Inc. totaling approximately $11.5 billion, including debt at a 30% premium with an expected close date within the first quarter of 2025.

DETRACTORS

Acadia Healthcare (ACHC), a behavioral healthcare and substance abuse treatment services company, continues to be impacted by the negative sentiment surrounding the news headlines related to patient care and questions about billing practices. While we take these developments seriously, we believe investors’ reaction to the news has been more severe than warranted. Industry peers have faced similar levels of scrutiny in the past with limited fundamental impact, and unless additional information is uncovered, we believe the current scrutiny will be resolved without much of an impact on their business. We continue to believe the company is well positioned to be an important part of the solution to an unfortunately growing need for behavioral health services.

Ardmore Shipping (ASC), a product and chemical transportation company focused on modern mid-sized vessels, experienced headwinds due to a combination of factors including a weakening tanker market with lower spot rates, potential concerns about geopolitical instability impacting shipping routes, and a general market downturn affecting the shipping industry. We maintain a position, as we believe the company continues to operate from a position of strength, driven by recent shareholder-friendly capital allocation decisions, strong operating performance, and a favorable industry supply-demand backdrop.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| Amentum Holdings | Aspen Technology |

| Americold Realty Trust | Infinera |

| Axalta Coating Systems | |

| Hexcel | |

| Tronox |

BUYS/ACQUISITIONS

Amentum Holdings (AMTM), is a global engineering and technology solutions provider serving the US government agencies as well as international government agencies from allied nations. The company was formed by spin-off and merger of Jacobs Solutions’ (J) Critical Mission Solutions (CMS) and Cyber & Intelligence (CI) businesses with Amentum Holdings (private). As a result, existing J shareholders received shares of the newly formed combined company (AMTM). We maintained our position in AMTM as we believe the company is well positioned to benefit from government spending on digital modernization, cybersecurity and next generation technologies. The combination of the two companies exposes AMTM to new end market and geographic opportunities as well as operating scale efficiencies to drive incremental shareholder value.

Americold Realty Trust (COLD), a global leader in temperature-controlled logistics, offering innovative technology-oriented supply chain and cold storage solutions to food producers, processors, distributors, and retailers was added to the portfolio. We believe that company-specific productivity initiatives coupled with strong industry dynamics are underappreciated by the market and not reflected in our estimate of the current valuation.

Axalta Coating System (AXTA), a global manufacturer, marketer and distributor of high-performance liquid and powder coating solutions for commercial and light vehicle, industrial and aftermarket refinishing. In addition to an expected cyclical rebound in demand for the company’s products, self-help initiatives implemented by a new management team will likely drive stronger revenue and earnings growth over the next several years.

Hexcel (HXL), develops and manufactures structural materials for use in commercial aerospace, space and defense, and industrial applications. As a leading supplier of carbon fiber, honeycomb and other composite materials for the aerospace industry the company’s financial performance has been negatively impacted by Covid-era disruptions and Boeing’s company-specific manufacturing problems. We believe the combination of company-specific self-help initiatives and an improving outlook for commercial aircraft build rates bodes well for improved financial performance from HXL.

Tronox (TROX), a leading global manufacturer of titanium dioxide pigment, a key ingredient in paint, plastics and a variety of other industrial applications, was added to the portfolio. Expectations for a cyclical recovery in demand combined with a changing competitive backdrop plus the benefit of cost savings initiatives should allow TROX to produce improved financial performance over the next several years.

SELLS/LIQUIDATIONS

Aspen Technology (AZPN), is an industrial software company that provides software solutions that optimize asset performance and operational efficiency for industries such as energy, chemicals, and manufacturing. The company was sold as the stock price appreciated after Emerson Electric proposed to buy the 42.6% of Aspen’s outstanding shares it currently does not own, causing the reward/risk ratio to compress.

Infinera (INFN), a global provider of advanced optical networking solutions for service providers, cloud operators, and enterprises, was acquired by Nokia at a 28% premium for both stock and cash. The position was sold as Nokia’s market cap is too large for the small cap strategy.

Outlook

We continue to remain optimistic about the long-term potential for the small-cap segment of the U.S. market. Valuations within the small-cap segment remain compelling relative to large caps, with the Russell 2000 Index trading near multi-decade lows on a relative basis. Potential tailwinds, including deregulation, increased M&A activity, the continued decline in interest rates, continued reshoring of U.S. manufacturing, and infrastructure-related spending, could provide additional support for small-cap stocks. Nonetheless, we remain mindful of risks such as a potential reacceleration in inflation, geopolitical tensions, and ongoing pressures in commercial real estate and regional banking.

Positioning

Our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Overweights in Industrials and Information Technology are mostly a function of our underlying company specific views rather than any top-down predictions for each sector. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling long-term opportunities that fit our discipline given the rising risk profiles of many retail businesses and a potential deceleration in goods spending following a period of strength. While the portfolio’s allocation to Health Care is modestly below that of the benchmark, we continue to remain underweight the Biotechnology industry as many companies within that group do not fit our discipline due to their elevated levels of binary risk. Given our focus on long-term business fundamentals, patient investment approach and low portfolio turnover, the strategy’s sector positioning generally does not change significantly from quarter to quarter. However, we may take advantage of periods of volatility by adding selectively to certain companies when appropriate.

The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice.

Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs.

These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments.

The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass.

Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2501-20

Sources: CAPS Composite Hub, Russell Investments

Composite returns for periods ended December 31, 2024, are preliminary pending final account reconciliation.

*The Aristotle Small Cap Equity Composite has an inception date of November 1, 2006, at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015, was achieved at Aristotle Boston.

**For the period November 2006 through December 2006.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized.

Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Please see important disclosures enclosed within this document.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Growth® Index measures the performance of the small cap companies located in the United States that also exhibit a growth probability. The Russell 2000 Value® Index measures the performance of the small cap companies located in the United States that also exhibit a value probability. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices.