Commentary

Focus Growth 3Q 2024

Markets Review

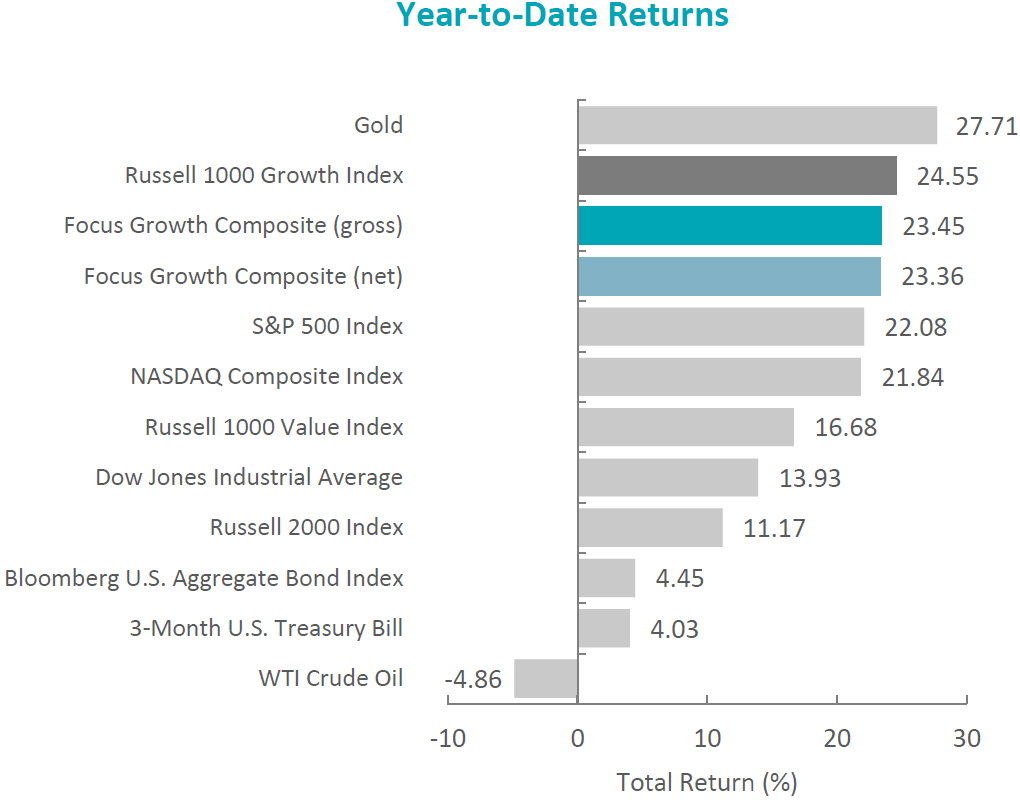

The U.S. equity market continued its ascent to new record highs, with the S&P 500 Index increasing 5.89% during the period. However, unlike last quarter, the market showed broader gains, with the S&P 500 Equal Weight Index outperforming the cap-weighted S&P 500 Index by 3.71%. Concurrently, the Bloomberg U.S. Aggregate Bond Index rose 5.20% for the quarter as interest rates declined. In terms of style, the Russell 1000 Value Index outperformed its growth counterpart by 6.24%.

Sources: CAPS CompositeHubTM, Bloomberg

Past performance is not indicative of future results. Aristotle Atlantic Focus Growth Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Atlantic Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

On a sector basis, gains were made from all eleven sectors within the Russell 1000 Growth Index, led by Utilities and Real Estate. The worst-performing sectors were Communication Services and Health Care.

After slowing down for two consecutive quarters, U.S. economic growth accelerated to an annualized rate of 3.0%, as consumer spending and private inventory investments increased. Additionally, inflation inched closer to the Federal Reserve’s 2.0% target, with the CPI increasing at an annualized rate of 2.5% in August and 2.9% in July. Meanwhile, the U.S. labor market cooled slightly, with unemployment at 4.2% and nominal wage growth moderating during the period.

Given the ongoing progress toward target inflation and a softening labor market, the Federal Reserve lowered the target range of the federal funds rate by 50 basis points to 4.75% to 5.00%. Fed Chair Powell acknowledged that loosening policy restraint too quickly could undo progress on inflation, whereas moving too slowly could undermine economic activity and weaken employment. Therefore, Powell stressed the importance of monitoring economic data before making further adjustments to monetary policy.

Corporate earnings remained strong, with S&P 500 companies reporting earnings growth of 11.3%, the highest year-over-year improvement since 2021. Furthermore, only 67 S&P 500 companies issued negative EPS guidance, and about 80% exceeded estimates. Reflecting the general trend of disinflation and a resilient domestic economy, fewer companies mentioned topics like “inflation” and “recession” during earnings calls.

In political news, President Biden announced he would not seek re-election. Vice President Kamala Harris was subsequently named the official Democratic presidential nominee for the 2024 election. In geopolitics, tensions in the Middle East escalated as clashes between Israeli forces and Hezbollah fighters intensified. In response, the U.S. announced the urgent deployment of additional troops to the region in case of a wider regional conflict, while simultaneously mediating a potential ceasefire between the groups.

Performance and Attribution Summary

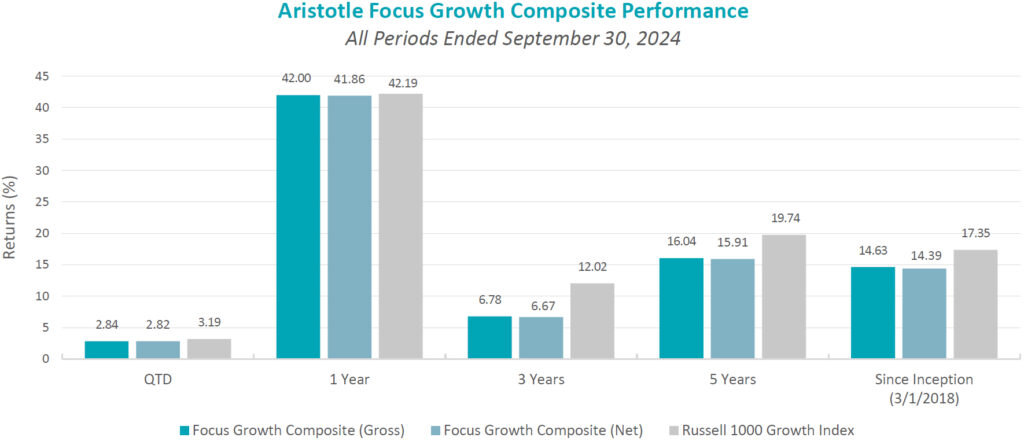

For the third quarter of 2024, Aristotle Atlantic’s Focus Growth Composite posted a total return of 2.84% gross of fees (2.82% net of fees), underperforming the 3.19% total return of the Russell 1000 Growth Index.

| Performance (%) | 3Q24 | 1 Year | 3 Years | 5 Years | Since Inception* |

|---|---|---|---|---|---|

| Focus Growth Composite (gross) | 2.84 | 42.00 | 6.78 | 16.04 | 14.63 |

| Focus Growth Composite (net) | 2.82 | 41.86 | 6.67 | 15.91 | 14.39 |

| Russell 1000 Growth Index | 3.19 | 42.19 | 12.02 | 19.74 | 17.35 |

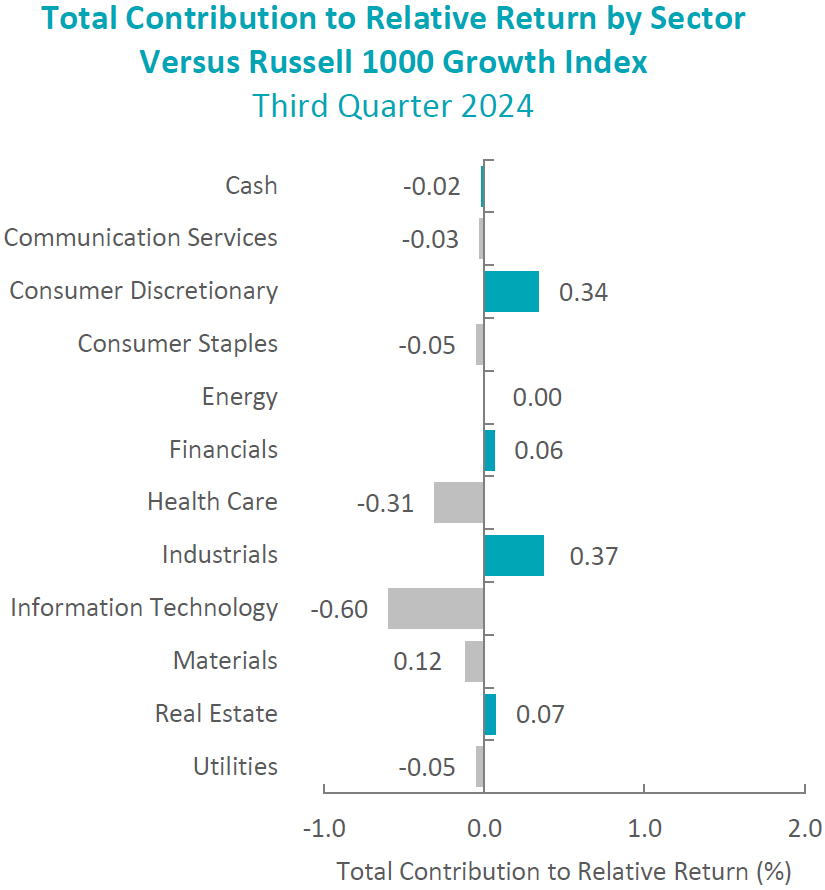

Sources: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income. Please see important disclosures at the end of this document.

During the third quarter, the portfolio’s underperformance relative to the Russell 1000 Growth Index was primarily due to security selection. Security selection in Information Technology and Health Care detracted the most from relative performance. Conversely, security selection in Industrials and Consumer Discretionary contributed to relative performance.

Contributors and Detractors for 3Q 2024

| Relative Contributors | Relative Detractors |

|---|---|

| Trane Technologies | Dexcom |

| S&P Global | Synopsys |

| Expedia Group | Guardant Health |

| Home Depot | KLA Corporation |

| ServiceNow | Datadog |

Contributors

Trane Technologies

Trane Technologies contributed to performance in the third quarter. After reporting second quarter earnings and revenue that exceeded consensus estimates in early August, the company’s management appeared at multiple investor events in September where they spoke about opportunities for the HVAC market. There is strength in the commercial business related to improving energy efficiency demand broadly and additional cooling opportunities in data centers. The residential business is beginning to recover after a period of weakness.

S&P Global

S&P Global contributed to portfolio performance in the third quarter, driven by growth in corporate bond issuance and refinancing activity, with expectations for further acceleration if interest rates decline. The company has also achieved better-than-expected expense and revenue synergies from its acquisition of IHS Markit.

Detractors

Dexcom

Dexcom detracted from performance in the third quarter following an uncharacteristic earnings miss, which manifested late in the quarter. The miss was attributed to share loss in the durable medical equipment (DME) channel, reaching a full rebate threshold with insurance companies sooner than expected and a recent salesforce realignment that resulted in slower new patient starts. Management was clear that these are Dexcom specific issues around execution and that they were taking action to remediate those effects. The company stood by their long-range plan which calls for 15%-plus topline growth. We believe Dexcom now trades at a relatively attractive valuation given the strong long-term growth profile.

Synopsys

Synopsys detracted from performance in the third quarter as the stock was part of the general investor pullback in AI-related semiconductor names due to concerns about overall AI market growth in the near-term and profitability of the massive capex investments being made in AI infrastructure. The company continues to execute well on its AI-enhanced product suite and Synopsys IP and Tools continue to be an integral part of the semiconductor design and manufacturing supply chain. As semiconductor companies and enterprises continue to rely on increasingly complex semiconductors in their technology stack, we see Synopsys as a key beneficiary of the increased design and manufacturing spend.

Recent Portfolio Activity

The table below shows all buys and sells completed during the quarter, followed by a brief rationale.

| Buys | Sells |

|---|---|

| Linde | IDEXX Laboratories |

| Thermo Fisher Scientific |

Buys

Linde

Linde is the largest industrial gas company worldwide and a major technological innovator in the industry. The company produces atmospheric gases like oxygen, nitrogen, argon, and rare gases through air separation processes, with cryogenic air separation being the most prevalent. They also have technologies to produce blue and green hydrogen, which are considered clean energy. Linde uses three basic distribution methods for industrial gases: on-site or tonnage, merchant or bulk liquid, and packaged or cylinder gases. These methods are often integrated, with products from all three supply modes coming from the same plant. The method of supply is determined by the lowest cost means of meeting the customer’s needs.

Linde holds a leading market share in a consolidated industry, with expected revenues of approximately $34 billion in 2024. The company has consistently grown its earnings throughout economic cycles due to its exposure to both cyclical end markets and is secured by long-term supply agreements of at least three years, providing defensive characteristics to its operating model. We see a robust backlog and pipeline driven by attractive growth end markets and significant decarbonization opportunities with operational discipline from management.

Sells

IDEXX Laboratories, Inc.

We sold IDEXX Laboratories on concerns that the cumulative effects of past pricing power and subdued volume growth will begin to impact sales growth as pricing power subsides. Furthermore, signs point to a slowing consumer, which could soften demand for vet services and thus adversely affect testing volumes. IDEXX trades at a premium multiple, and we have seen signs of slowing growth having outsized impacts on stock prices in the most recent earnings period.

Thermo Fisher Scientific Inc.

We sold Thermo Fisher Scientific due to the reduction in the Health Care weighting in the Russell 1000 Growth benchmark as a result of the annual rebalance. Furthermore, we believe that Thermo is trading at a full valuation based on its expected earnings growth and the softness in some life science-related end markets.

Outlook

The equity markets in the third quarter posted positive returns, led by the interest rate sensitive sectors of Utilities and Real Estate. The sector performance reflected a sizable decline in interest rates with the 10-year U.S. Treasury yield down by about 70 basis points for the quarter. Economic activity continued to show signs of moderating with the ISM Manufacturing Index remaining in contraction territory and employment statistics slowing. Equity valuation levels remain elevated compared to historical levels, leaving little room for a sizable multiple expansion. There has been no improvement in the geopolitical situation and the US Presidential election remains a toss-up. The market has become more sensitive to a potential recession and declining earnings and less focused on inflation. Although the upside is more muted given the elevated valuation levels, the backdrop of lower interest rates and moderate earnings growth should support equity markets. Our focus will continue to be at the company level, with an emphasis on seeking to invest in companies with secular tailwinds or strong product-driven cycles.

The opinions expressed herein are those of Aristotle Atlantic Partners, LLC (Aristotle Atlantic) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to purchase or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Atlantic makes in the future will be profitable or equal the performance of the listed in this report. The portfolio characteristics shown relate to the Aristotle Atlantic Focus Growth strategy. Not every client’s account will have these characteristics. Aristotle Atlantic reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Atlantic’s Focus Growth Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Atlantic does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Atlantic Partners, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Atlantic, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. AAP-2410-22.

Sources: CAPS CompositeHubTM, Russell Investments

Composite returns for all periods ended September 30, 2024 are preliminary pending final account reconciliation.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. This index has been selected as the benchmark and is used for comparison purposes only. The Russell 1000® Value Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance. The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Dow Jones Industrial Average® is a price-weighted measure of 30 U.S. blue-chip companies. The Index covers all industries except transportation and utilities. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite includes over 3,000 companies, more than most other stock market indices. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment grade bonds, including corporate, government and mortgage-backed securities. The WTI Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil consumed in the United States. The 3-Month U.S. Treasury Bill is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of three months. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors. The volatility (beta) of the Composite may be greater or less than its respective benchmarks. It is not possible to invest directly in these indices.