Commentary

International Equity 1Q 2023

(All MSCI index returns are shown net and in U.S. dollars unless otherwise noted.)

Markets Review

Sources: SS&C Advent, Bloomberg

Past performance is not indicative of future results. Aristotle International Equity Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Capital Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

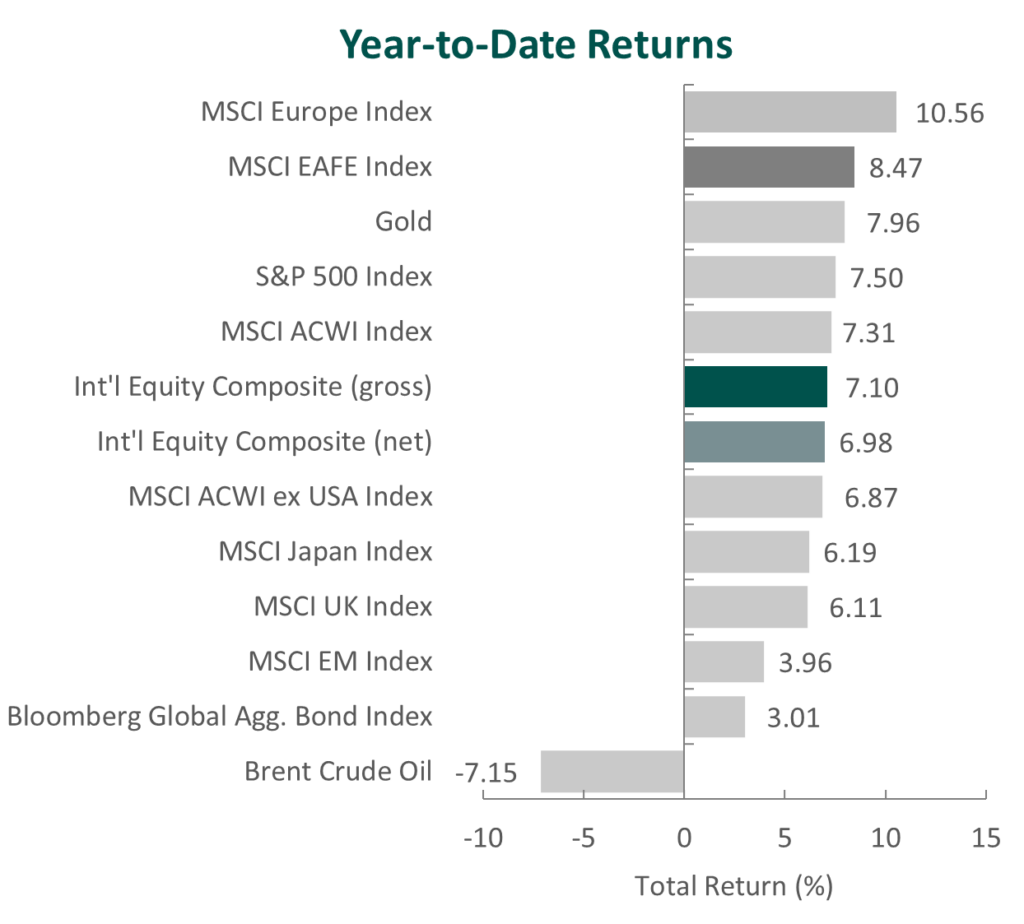

Global equity markets rose in the first quarter of the year, as the MSCI ACWI Index increased 7.31% during the period. Concurrently, the Bloomberg Global Aggregate Bond Index increased 3.01%. In terms of style, growth stocks outperformed their value counterparts during the quarter, with the MSCI ACWI Growth Index beating the MSCI ACWI Value Index by 12.54%.

The MSCI EAFE Index climbed by 8.47% during the first quarter, while the MSCI ACWI ex USA Index increased 6.87%. Within the MSCI EAFE Index, Europe & Middle East and the U.K. were the strongest-performing regions, while Asia gained the least. On a sector basis, ten out of the eleven sectors within the MSCI EAFE Index posted positive returns, with Information Technology, Consumer Discretionary and Industrials generating the largest gains. Conversely, Real Estate was the only sector to finish in the red, while Energy and Financials gained the least.

Despite continued geopolitical tensions, persistent inflation and new concerns in the banking industry, the global economy proved to be resilient. This was seen by strong labor markets, robust household consumption and business investment in addition to effective management of Europe’s energy crisis. Additionally, China continued its relaxation of strict COVID rules by fully reopening its borders to travelers with all types of visas. As a result, the IMF increased its growth forecasts and now projects global growth of 3.4%, 2.9% and 3.1% in 2022, 2023 and 2024, respectively.

Inflation remained elevated in many regions, with the U.K. and eurozone reporting a 10.4% and 8.5% rate, respectively. Meanwhile, in Asia, Japan’s core consumer inflation hit a 41-year high of 4.2%. However, the pace of price increases moderated for other countries. This was the case for China and South Korea, where inflation rates declined to their lowest levels in 12 and 10 months, repectively. On a forward-looking basis, the IMF estimates global inflation will fall from 8.8% in 2022 to 6.6% in 2023 and 4.3% in 2024. The organization believes restrictive monetary policy and cooling commodity prices due to weaker demand will contribute to the pattern of disinflation.

During the quarter, the failure of U.S.-based, mid-sized institutions Silicon Valley Bank (SVB) and Signature Bank reverberated into the international market, adding a layer of complexity to restrictive central bank policies. After SVB’s closure due to a run on deposits, Credit Suisse also experienced withdrawals, further exacerbated by a subsequent plunging share price that led Swiss regulators to orchestrate a takeover by UBS. As a result of the turmoil in the banking sector, central banks in the U.S. and Europe have commented that credit conditions may have tightened more than some economic indicators currently suggest.

Lastly, on the geopolitical front, the war in Ukraine rages on in the eastern side of the country while southern lines have largely stabilized. Though China continues to align itself with Russia, China’s Ministry of Foreign Affairs released a paper calling for all parties to support dialogue to “gradually deescalate the situation.” Meanwhile, Western nations continue to support Ukraine, with commitments from the U.S., Germany and Britain to supply armored vehicles.

Performance and Attribution Summary

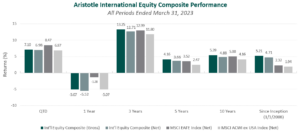

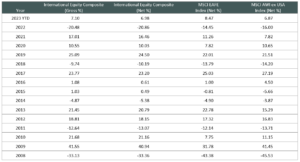

For the first quarter of 2023, Aristotle Capital’s International Equity Composite posted a total return of 7.10% gross of fees (6.98% net of fees), underperforming the MSCI EAFE Index, which returned 8.47%, and outperforming the MSCI ACWI ex USA Index, which returned 6.87%. Please refer to the table below for detailed performance

| Performance (%) | 1Q23 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception* |

|---|---|---|---|---|---|---|

| International Equity Composite (gross) | 7.10 | -5.07 | 13.25 | 4.16 | 5.39 | 5.21 |

| International Equity Composite (net) | 6.98 | -5.52 | 12.71 | 3.66 | 4.88 | 4.71 |

| MSCI EAFE Index (net) | 8.47 | -1.38 | 12.99 | 3.52 | 5.00 | 2.32 |

| MSCI ACWI ex USA Index (net) | 6.87 | -5.07 | 11.80 | 2.47 | 4.16 | 1.94 |

Source: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income.

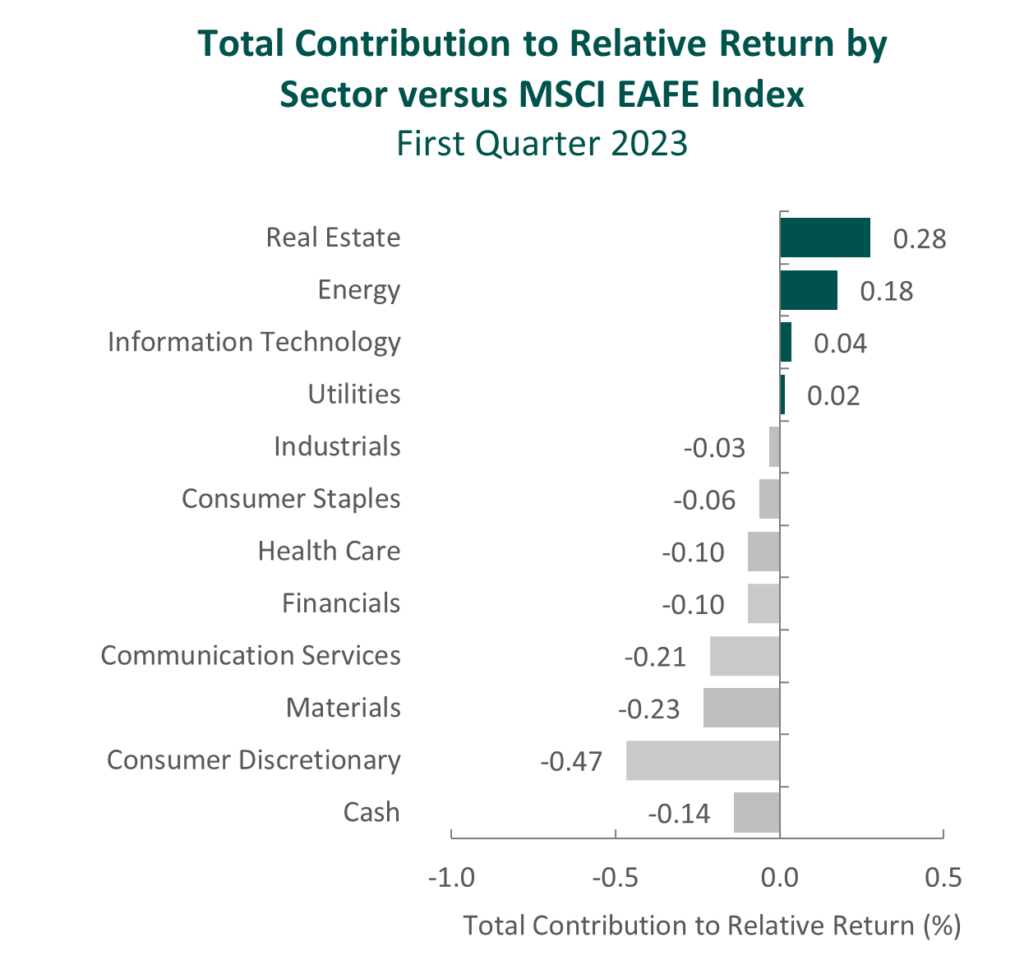

From a sector perspective in the first quarter, the portfolio’s underperformance relative to the MSCI EAFE Index can be attributed to security selection, while allocation effects had a positive impact. Security selection in Consumer Discretionary, Information Technology and Materials detracted the most from the portfolio’s relative performance. Conversely, overweights in Information Technology and Consumer Discretionary and a lack of exposure to Real Estate contributed to relative return.

Regionally, both security selection and allocation effects were responsible for the portfolio’s underperformance. Security selection in Europe and exposure to Canada detracted the most from relative performance, while an underweight and security selection in Asia contributed.

Contributors and Detractors for 1Q 2023

| Relative Contributors | Relative Detractors |

|---|---|

| Nemetschek | Magna International |

| LVMH | Credicorp |

| Sony | DBS Group |

| Rentokil Initial | Koninklijke DSM |

| FANUC | AIA Group |

Magna International, a Canada-based global auto parts, systems and assembly company, was a leading detractor during the quarter. The company continues to be impacted by the volatile production schedules of auto OEMs, primarily caused by semiconductor supply constraints. For some of Magna’s major customers, volumes are as low as 50%-60% of the contracted plan. This has created short-term inefficiencies in Magna’s ability to manage labor and its overall cost structure. However, we believe these headwinds are temporary in nature, as supply chains and car production levels will normalize over time. We instead remain focused on Magna’s unique capability of supplying parts for an increasingly electrified and autonomous fleet of vehicles. This includes Magna’s specialty in lightweighting vehicles—a necessity for heavy electric cars—as well as its years of investment in self-driving technologies. In addition, Magna signed an agreement in December 2022 to acquire Veoneer Active Safety for approximately $1.5 billion in cash. Veoneer’s advanced driver-assistance system (ADAS) technologies and Magna’s existing ADAS group, in our view, will benefit from enhanced scale and a larger product portfolio, ultimately allowing the company to reach a broader customer base.

AIA Group, a pan-Asian life insurance company headquartered in Hong Kong, was one of the largest detractors for the quarter. As a result of bank failures in both the U.S. and Europe, insurance companies were also scrutinized as potential vulnerabilities within the global financial system. However, given AIA’s strong capital position and ample liquidity, we believe the company is well positioned to withstand market volatility. In contrast to banks, life insurance companies like AIA have longer-duration liabilities than assets. This avoids liquidity pressure when interest rates rise and fixed-income portfolios are marked-to-market. We also see AIA’s investment exposure as limited due to its highly diversified corporate bond portfolio (with more than 1,900 issuers) and less than 5% of total invested assets in equities. As such, we remain focused on the company’s ability to benefit from its increasingly technology-enabled and productive agency salesforce. In fact, AIA’s VONB increased 6% in the second half of 2022, with growth across all of its largest markets. Moreover, we expect the company to further establish its direct presence in mainland China, a catalyst we previously identified, as it plans to reach another 10-12 affluent cities in the country by 2026.

LVMH Moët Hennessy Louis Vuitton, the luxury goods company, was a primary contributor for the quarter. China, one of the world’s largest luxury goods markets, has reopened following three years of various COVID lockdown policies and provided a boost for LVMH. While we are pleased to see the company (and industry) benefit from an improved macroeconomic environment, this is not, and was not, our focus when analyzing the fundamentals of LVMH’s business. Instead of attempting to time short-term factors out of the company’s control, we remain fixated on what LVMH can control. This includes the company’s progress on initiatives such as integrating the acquisitions of Tiffany & Co. and, most recently, the Pedemonte Group to bolster its Jewelry division; market share gains within the Fashion & Leather Goods segment; continued market leadership with the likes of Dior’s Sauvage being named the world leader in perfumes for 2022; and the expansion of the company’s store network and the development of production facilities. These improvements, we believe, more directly impact the company’s long-term fundamental outlook, regardless of the short-term macroeconomic landscape. Lastly, LVMH appointed Pharrell Williams as its new Men’s Creative Director, filling the role following the tragic passing of Virgil Abloh in 2021.

Rentokil Initial, the U.K.-based pest control and hygiene services company, was a leading contributor for the quarter. In late 2022, the company completed its previously announced $6.7 billion acquisition of Terminix to further solidify its position in the North American pest control market. We believed the acquisition, its largest ever, would provide operational synergies from scale efficiencies and in-market densification, as well as accelerate the consolidation of the U.S. pest control market. Initially, Rentokil estimated $150 million in cost synergies by 2025, and the company recently upgraded its target to at least $200 million. We are encouraged by the company’s integration progress and operations, which in turn have led to Rentokil’s highest operating margin in 20 years. We believe the fundamental improvements, combined with the resilient nature of the pest control business, will allow Rentokil to continue to unlock value in the years ahead.

Recent Portfolio Activity

| Buys | Sells |

|---|---|

| None | Brookfield Asset Management |

During the quarter, we sold our position in Brookfield Asset Management.

We have been owners of Brookfield for well over a decade, having first invested in the fourth quarter of 2009. In December 2022, the company completed the spinoff of 25% of its asset management business, now known as Brookfield Asset Management (“Manager,” ticker: BAM). As part of the spinoff, the parent company, Brookfield Corporation (“Corporation,” ticker: BN), retained a 75% interest in the Manager. As such, we decided to sell our stake in the Manager and use the proceeds to top-up our investment in the Corporation. While we continue to find the Manager’s business attractive, we view Brookfield Corporation as a more optimal investment.

Conclusion

A core tenet of our investment philosophy is the commitment to understand businesses with a long-term perspective. For us, this is especially important during times of heightened uncertainty when macroeconomic events dominate headlines. We remain aware of short-term topics such as inflation, monetary policy and the recent shock to the banking system. However, we believe a competitive advantage of our investment process lies in the fact that, instead of reacting and repositioning our portfolio based on unknowns and unfolding events, our focus remains on business fundamentals. Fundamentals, we are convinced, are what dictate shareholder value in the long term. As such, we continue to attentively study what we believe are high-quality companies with sustainable competitive advantages poised to outperform their peers over full market cycles.

The opinions expressed herein are those of Aristotle Capital Management, LLC (Aristotle Capital) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to buy or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Capital makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle International Equity strategy. Not every client’s account will have these characteristics. Aristotle Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Capital’s International Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Capital does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Capital Management, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Capital, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACM-2304-42

Composite returns for all periods ended March 31, 2023 are preliminary pending final account reconciliation.

Past performance is not indicative of future results. The information provided should not be considered financial advice or a recommendation to purchase or sell any particular security or product. Performance results for periods greater than one year have been annualized.

Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. The MSCI EAFE Index consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The MSCI ACWI captures large and mid-cap representation across 23 developed market countries and 24 emerging markets countries. With approximately 3,000 constituents, the Index covers approximately 85% of the global investable equity opportunity set. The MSCI ACWI Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 developed markets countries and 24 emerging markets countries. The MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 developed markets countries (excluding the United States) and 24 emerging markets countries. With approximately 2,300 constituents, the Index covers approximately 85% of the global equity opportunity set outside the United States. The MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 24 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Brent Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. The MSCI Japan Index is designed to measure the performance of the large and mid-cap segments of the Japanese market. With approximately 250 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in Japan. The Bloomberg Global Aggregate Bond Index is a flagship measure of global investment grade debt from 28 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The MSCI United Kingdom Index is designed to measure the performance of the large and mid-cap segments of the U.K. market. With nearly 100 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in the United Kingdom. The MSCI Europe Index captures large and mid-cap representation across 15 developed markets countries in Europe. With approximately 430 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization across the European developed markets equity universe. These indices have been selected as the benchmarks and are used for comparison purposes only. The volatility (beta) of the Composite may be greater or less than the respective benchmarks. It is not possible to invest directly in these indices.