Commentary

Core Equity 4Q 2022

Markets Review

U.S. equity market performance was positive in the final quarter of the year, as the S&P 500 Index rose 7.56% during the period. Concurrently, the Bloomberg U.S. Aggregate Bond Index increased 1.87% for the quarter. In terms of style, the Russell 1000 Value Index outperformed its growth counterpart by 10.22% during the quarter.

On a sector basis, nine out of eleven sectors within the S&P 500 Index finished higher for the quarter, with Energy, Industrials and Materials posting the largest gains. Meanwhile, Consumer Discretionary and Communication Services were the only sectors to post negative returns, while Real Estate rose the least.

Sources: SS&C Advent, Bloomberg

Past performance is not indicative of future results. Aristotle Atlantic Core Equity Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Atlantic Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Inflation has remained elevated in the U.S., with a 7.1% rise in the CPI for the 12-month period ending in November. However, increases have slowed since the second half of the year, as the annualized CPI figure has come down steadily since reaching a 40-year high of 9.1% in June. This moderation in price increases was partly driven by falling energy costs, as average U.S. gasoline prices approached $3 a gallon—lows not seen since before Russia invaded Ukraine. When assessing consumer health, spending proved resilient and the labor market remained tight, with a 3.7% unemployment rate and a 5.1% year-over-year increase in average hourly earnings in November. With respect to the U.S. economy’s overall performance, investors welcomed news that GDP grew at an annual rate of 3.2% in the third quarter following two consecutive quarters of contraction.

As inflation trended lower, the Federal Reserve (Fed) slowed the pace of rate increases to 0.5% in December after raising rates by 0.75% for the fourth consecutive time in November, moving the benchmark rate to a range of 4.25% to 4.50%. Although the magnitude of rate hikes has shifted down, the Fed has indicated that, given the current labor market and its 2% inflation target, there is still more work to be done from a monetary policy standpoint. As such, apprehension around a recession remains; however, the Fed’s decision to step down from 0.75% increases and the weakening dollar alleviated some of those concerns heading into the new year.

On the corporate earnings front, signals remained mixed, as 70% of S&P 500 companies exceeded EPS estimates, while 61% of S&P 500 companies provided negative EPS guidance for the third quarter. In addition, management teams have continued to navigate the inflationary environment, with roughly 400 companies mentioning inflation on earnings calls.

Lastly, in U.S. politics, the Republican Party won a majority in the House of Representatives, while the Democratic Party retained control of the Senate after the 2022 midterm elections. The results end one-party control of Congress for the remainder of the Biden administration’s first term.

Annual Markets Review

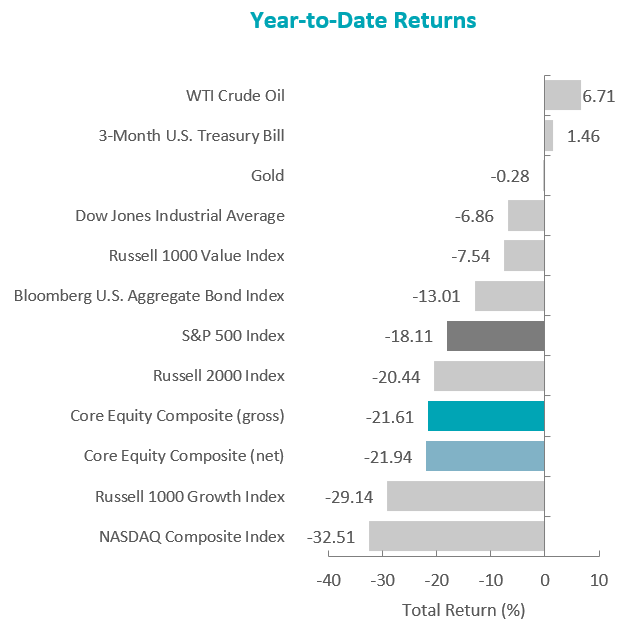

After posting seven consecutive quarters of positive performance prior to 2022, the U.S. equity market faltered, as the S&P 500 Index finished lower for the first three quarters of the year, leading to a full-year return of -18.11%. Additionally, after five straight calendar years of growth outperforming value, the Russell 1000 Value Index outperformed the Russell 1000 Growth Index by 21.60%, the largest outperformance by value since 2000.

Meanwhile, despite fixed income’s tendency to provide stability when equities are turbulent, the Bloomberg U.S. Aggregate Bond Index fell 13.01%—its worst year on record. 2022 easily surpassed the Index’s previous worst year, when it declined 2.92% in 1994 as inflation and the corresponding interest rate environment remained primary themes. Macroeconomic headlines were dominated by inflation, while factors such as geopolitical conflict, supply-chain disruptions, labor shortages and increasing commodity and housing prices also played a role.

Although it was a challenging year, these volatile periods are precisely why we emphasize the phrase, “not every quarter, not every year.” Short-term returns are always subject to change, and macroeconomic factors such as inflation, central bank policies and geopolitical conflicts are impossible to predict. Consequently, we remain focused on the long-term fundamentals of businesses, and we strive to identify undervalued, high-quality companies that can weather the complex and changing market dynamics. We believe this steadfast approach will allow us to provide lasting long-term value to our clients.

Performance and Attribution Summary

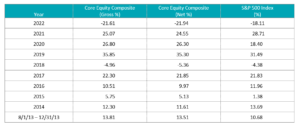

For the fourth quarter of 2022, Aristotle Atlantic’s Core Equity Composite posted a total return of 6.92% net of fees (7.03% gross of fees), underperforming the S&P 500 Index, which recorded a total return of 7.56%.

| 4Q22 | 1 Year | 3 Years | 5 Years | 7 Years | Since Inception* | |

|---|---|---|---|---|---|---|

| Core Equity Composite (gross) | 7.03 | -21.61 | 7.52 | 9.92 | 11.69 | 12.09 |

| Core Equity Composite (net) | 6.92 | -21.94 | 7.08 | 9.47 | 11.22 | 11.57 |

| S&P 500 Index | 7.56 | -18.11 | 7.65 | 9.42 | 11.47 | 11.24 |

Source: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income. Please see important disclosures at the end of this document.

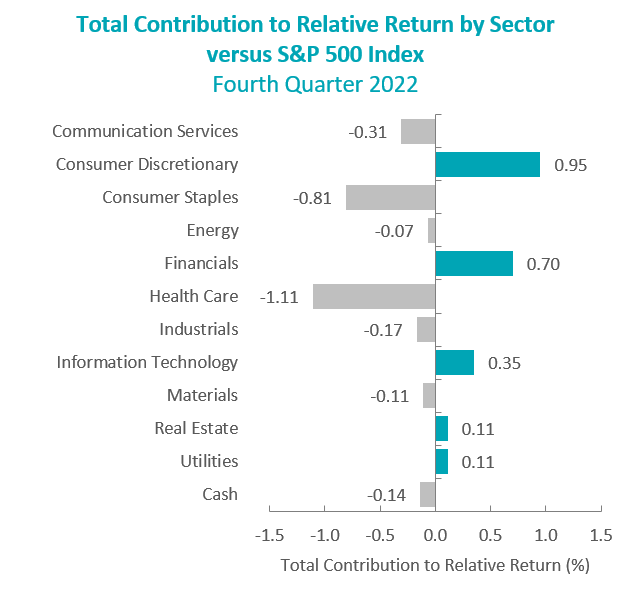

During the fourth quarter, the portfolio’s underperformance relative to the S&P 500 Index was due to security selection and allocation effects. Security selection in Health Care, Consumer Staples and Industrials detracted the most from relative performance. Conversely, security selection in Consumer Discretionary, Financials and Information Technology contributed the most to relative performance.

Contributors and Detractors for 4Q 2022

| Relative Contributors | Relative Detractors |

|---|---|

| AMETEK | Catalent |

| Broadcom | Chart Industries |

| Ameriprise Financial | Guardant Health |

| Halliburton | Darling Ingredients |

| Phillips 66 | Alphabet |

Contributors

AMETEK

AMETEK contributed to performance in the fourth quarter following a better-than-expected third quarter earnings report and an increase in full year guidance. The company has low balance sheet leverage and management appeared confident in its ability to source acquisitions. Management believes that the company’s recession risk is lower than in previous economic cycles due to the remixing of the portfolio to less cyclical end markets.

Broadcom

Broadcom contributed to performance in the quarter following the company’s solid fourth quarter 2022 results. This was driven by better-than-expected results in both its semiconductor solutions, networking and storage segments. The company also provided first quarter guidance that was ahead of consensus as well as 2023 commentary that expects earnings momentum to continue due to a strong product cycle.

Detractors

Catalent

Catalent shares were weak following an earnings miss and a reduction in guidance. The lowering of guidance is attributable to two items: slower consumer spending on the pharmaceutical and consumer health segment due to low consumer confidence, inflation and a deteriorating macroeconomic environment; and cash conservatism amongst customers in both retail (wanting to reduce inventory to protect working capital) and pharma/biotech, reprioritizing pipelines and slowing certain pipeline programs. Excluding COVID-19-related business, revenue grew in excess of 20% on an organic basis. As a result, their base businesses remain strong.

Chart Industries

Chart Industries detracted from performance in the fourth quarter following the announcement of the acquisition of Howden Group in early November. The acquisition diluted the clean energy exposure at Chart and will increase balance sheet leverage. In December, Chart successfully raised debt that is required to close the acquisition at interest rates that were in line with management’s expectations at the time of the announcement of the deal. The decline in natural gas prices in the fourth quarter was also likely a contributor to weakness in the shares.

Recent Portfolio Activity

The table below shows all buys and sells completed during the quarter, followed by a brief rationale.

| Buys | Sells |

|---|---|

| Antero Resources | None |

Buys

Antero Resources

Antero Resources is engaged in the development, production, exploration and acquisition of natural gas, natural gas liquids (NGLs) and oil properties located in the Appalachian Basin. Operating entirely within the U.S., Colorado-based Antero Resources holds approximately 502,000 net acres of oil and gas properties in Ohio and West Virginia. Antero Resources intends to leverage its team’s experience delineating and developing natural gas resource plays to continue developing its reserves and production, primarily on the company’s existing multi-year project inventory.

We see the company generating significant free cash flow (FCF) over the next few years and a sizable return of FCF to shareholders through buybacks. Antero Resources has significantly reduced its debt over the past three years. Longer-term structural tailwinds exist for natural gas and NGLs, as U.S. supply growth rates remains constrained by takeaway capacity additions and lower reinvestment rates by Exploration & Production (E&P), following years of shareholder pressure to reduce leverage and balance shareholder returns with growth. We continue to see a structural shift in demand for natural gas and NGLs supporting prices at these levels or higher leading to attractive FCF growth for Antero Resources.

Sells

There were no new sales completed during the quarter.

Outlook

The focus for equity investors going into 2023 will be the potential for an economic recession and the corresponding impact on corporate profits. Although inflation may have peaked, the Federal Reserve will potentially look to continue to raise interest rates and reduce their balance sheet in an effort to cool the labor market. One of the key statistics tracking the labor market is the Job Openings and Labor Turnover Survey (JOLTS), which has started to show signs of softening, with the number of job openings declining from recent highs. The gap between job openings and people looking for work still stands at an elevated ratio of 1.7 as of October 2022. With the labor market still tight, the Federal Reserve will most likely raise interest rates another two to three times in 2023 with the potential for the federal funds rate to peak at 5.00% to 5.25%. Although the federal funds futures point to the potential for a pivot into an easing cycle, the most likely scenario is for the Federal Reserve to take a wait-and-see approach once they are done raising interest rates. This can create an uncertain economic environment for at least the first half of 2023. On a positive note, the price of goods may likely continue to decline as many of the issues around tight supply chain have eased. The pace of decline in goods prices could very well be delayed or lessened by the spike in COVID-19 cases in China. As we approach the second half of the year, the debt ceiling could add to equity market volatility, as we now have a split party government. Lastly, the uncertain outcome and potential for escalation in Ukraine on the part of Russia may, at times, unsettle markets. The equity market will most likely struggle at the start of 2023, as investors weigh the economic impact of an aggressive tightening cycle. Once the Federal Reserve signals the end of the tightening cycle, we should expect a sizable rally in equity markets. Our focus will continue to be at the company level, with an emphasis on seeking to invest in companies with secular tailwinds or strong product-driven cycles.

Disclosures

The opinions expressed herein are those of Aristotle Atlantic Partners, LLC (Aristotle Atlantic) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to purchase or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Atlantic makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle Atlantic Core Equity strategy. Not every client’s account will have these characteristics. Aristotle Atlantic reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Atlantic’s Core Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Atlantic does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Atlantic Partners, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Atlantic, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request.

Composite returns for all periods ended December 31, 2022 are preliminary pending final account reconciliation.

Composite returns for all periods ended December 31, 2022 are preliminary pending final account reconciliation.

The Aristotle Core Equity Composite has an inception date of August 1, 2013 at a predecessor firm. During this time, Mr. Fitzpatrick had primary responsibility for managing the strategy. Performance starting November 1, 2016 was achieved at Aristotle Atlantic.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Aristotle Atlantic Partners, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Atlantic, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. AAP-2301-6

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. This index has been selected as the benchmark and is used for comparison purposes only. The Russell 1000® Value Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Dow Jones Industrial Average® is a price-weighted measure of 30 U.S. blue-chip companies. The Index covers all industries except transportation and utilities. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite includes over 3,000 companies, more than most other stock market indices. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment grade bonds, including corporate, government and mortgage-backed securities. The WTI Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil consumed in the United States. The 3-Month U.S. Treasury Bill is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of three months. The U.S. Dollar Index (DXY) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the United States’ most significant trading partners. Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors. The volatility (beta) of the Composite may be greater or less than its respective benchmarks. It is not possible to invest directly in these indices.