Commentary

Core Equity 3Q 2022

Markets Review

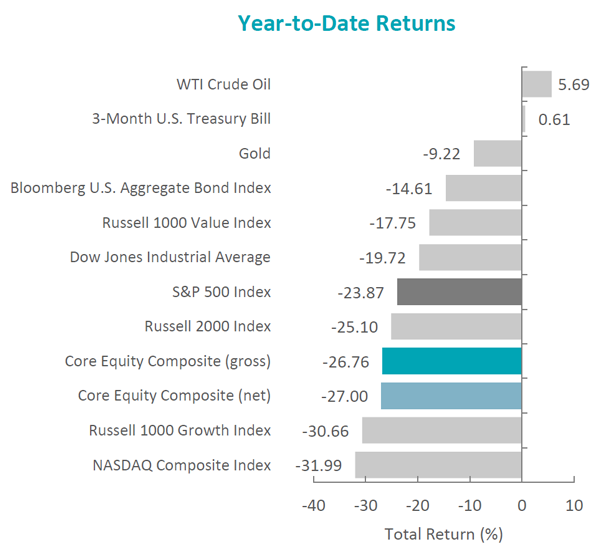

The U.S. equity market finished lower for the third consecutive quarter, as the S&P 500 Index fell 4.88% during the period, bringing its year-to-date return to -23.87%. Concurrently, the Bloomberg U.S. Aggregate Bond Index dropped 4.75% for the quarter, bringing its year-to-date return to -14.61%. In terms of style, the Russell 1000 Growth Index outperformed its value counterpart by 2.02% during the quarter. Nevertheless, for the year-to-date period, the Russell 1000 Value Index has still outperformed the Russell 1000 Growth Index by 12.91%.

Sources: SS&C Advent, Bloomberg

Past performance is not indicative of future results. Aristotle Atlantic Core Equity Composite returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Atlantic Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

On a sector basis, nine out of eleven sectors within the S&P 500 Index finished lower for the quarter, with Communication Services, Real Estate and Materials posting the largest declines. Consumer Discretionary and Energy were the only sectors to post positive returns, while Financials declined the least.

With sustained levels of heightened inflation and continued tightening by the Federal Reserve, recessionary fears persisted throughout the period, as the U.S. economy contracted in both the first and second quarters of 2022. After setting a new 40-year high in June, the CPI remained elevated, recording an 8.3% rise for the year ended in August. Higher prices have weighed on consumers, as sentiment hit multi-year lows. However, the labor market remains tight with unemployment at 3.5% in September. During the first nine months of 2022, payroll employment rose 3.7 million to a record 152.9 million. In tandem, consumer spending during the first and second quarters increased 1.8% and 1.5%, respectively, on a quarter-over-quarter basis.

In response, the Federal Reserve raised the federal funds rate 0.75% in both July and September, moving the benchmark rate to a range of 3.00% to 3.25%, all while continuing to unwind its balance sheet. Restrictive monetary policy has perhaps most visibly impacted interest-rate sensitive sectors, in particular housing, as mortgage rates breached 7%—a 20-year high—and residential investment declined 14% year-over-year in the second quarter. Additionally, the U.S. Dollar Index (DXY) reached a two-decade high, deepening concerns for the durability of U.S. export demand and causing some central banks such as the Bank of Japan to intervene and support their currency.

On the corporate earnings front, although 76% of the companies in the S&P 500 Index exceeded earnings expectations, 72 companies provided negative guidance, the most since the fourth quarter of 2019. The mixed signals highlight the continued backdrop of uncertainty heading into the last quarter of the year.

In geopolitical news, tensions between the U.S. and China flared up as Nancy Pelosi visited Taiwan despite protests from the Chinese deputy foreign minister. The worsening relations with China, combined with the ongoing war in Ukraine, continued to stoke concerns surrounding further geopolitical disruption, inflation and the outlook for global economic activity.

Performance and Attribution Summary

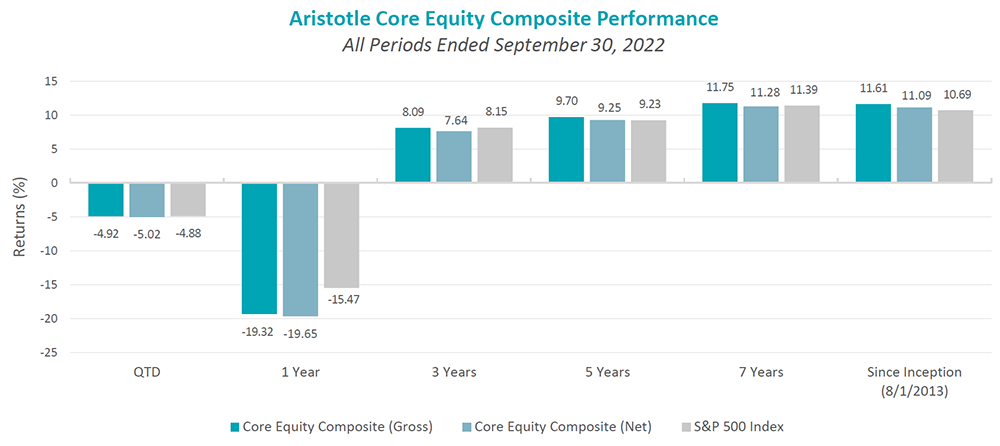

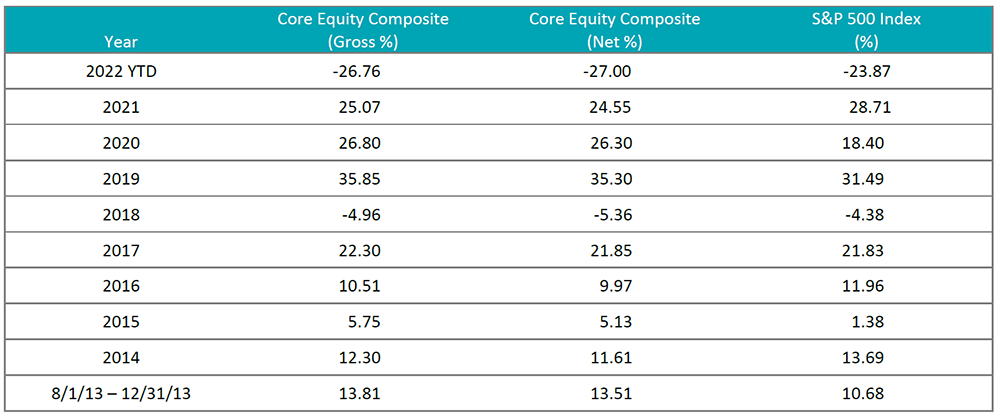

For the third quarter of 2022, Aristotle Atlantic’s Core Equity Composite posted a total return of -4.92% gross of fees (-5.02% net of fees), underperforming the S&P 500 Index, which recorded a total return of -4.88%. Since its inception on August 1, 2013, the Core Equity Composite has posted an annualized return of 11.61% gross of fees (11.09% net of fees), while the S&P 500 Index has reported a total return of 10.69%.

| 3Q22 | YTD | 1 Year | 3 Years | 5 Years | Since Inception* | |

|---|---|---|---|---|---|---|

| Core Equity Composite (gross) | -4.92 | -26.76 | -19.32 | 8.09 | 9.70 | 11.61 |

| Core Equity Composite (net) | -5.02 | -27.00 | -19.65 | 7.64 | 9.25 | 11.09 |

| S&P 500 Index | -4.88 | -23.87 | -15.47 | 8.15 | 9.23 | 10.69 |

Source: FactSet

Past performance is not indicative of future results. Attribution results are based on sector returns which are gross of investment advisory fees. Attribution is based on performance that is gross of investment advisory fees and includes the reinvestment of income. Please see important disclosures at the end of this document.

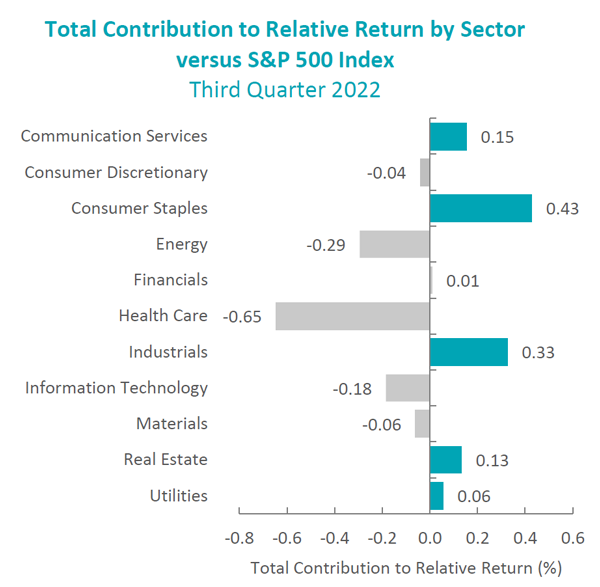

During the third quarter, the portfolio’s underperformance relative to the S&P 500 Index was entirely due to security selection. Security selection in Health Care, Energy and Information Technology detracted the most from relative performance. Conversely, security selection in Consumer Staples, Industrials and Communication Services contributed the most to relative performance.

Contributors and Detractors for 3Q 2022

| Relative Contributors | Relative Detractors |

|---|---|

| Darling Ingredients | Catalent |

| Cigna | ServiceNow |

| Ameriprise Financial | Bio-Techne |

| O’Reilly Automotive | Ball |

| Trane Technologies | Spirit AeroSystems Holdings |

Contributors

Darling Ingredients

Darling Ingredients was a relative contributor, bouncing back from weakness at the end of the prior quarter. The company reported, what we view, as solid second quarter earnings and gave positive guidance on future renewal diesel trends. The Energy sector was up in the third quarter, which also provided a tailwind to Darling’s energy operations.

Cigna

Cigna outperformed the S&P 500 Index in the third quarter, as the company reported what we view as solid second quarter results driven by a better-than-expected medical loss ratio. The company continues to be aggressive with share repurchases and we believe the defensive nature of Cigna’s business continues to be attractive during the ongoing macroeconomic uncertainty.

Detractors

Catalent

Catalent shares were weak in the third quarter. The company reported results in line with consensus for the second quarter, but provided initial fiscal 2023 guidance calling for 8% organic constant currency revenue growth which fell slightly below estimates. Catalent is seeing a sharp decline in COVID-19 vaccine production as the pandemic wanes. However, they are confident in their ability to repurpose those manufacturing assets to address market demand outside of COVID-19 vaccines. The stock ended the third quarter trading at what we think is an attractive valuation of 18.1x next twelve-month earnings estimates versus the 5-year average multiple of 27.7x.

ServiceNow

Underperformance in the third quarter can be attributed to ServiceNow’s slight miss on the second quarter earnings and guidance that was lower than expected for its third quarter outlook. The company is facing headwinds from the weaker macroeconomic conditions and a tempered outlook resulting from elongated sales cycles and an overall slowing software spending environment. These worsening conditions were highlighted by many software companies during the second quarter earnings season. We expect this to be temporary for ServiceNow where the long-term thesis of the company’s platform strategy and relevance to digital transformation strategies remains intact. The stock was also likely impacted by the rapid increase in interest rates during the third quarter and the resulting contraction of multiples on high-growth software stocks.

Recent Portfolio Activity

The table below shows all buys and sells completed during the quarter, followed by a brief rationale.

| Buys | Sells |

|---|---|

| Halliburton | Ball |

| Comcast |

Buys

Halliburton

Halliburton provides energy, engineering and construction services and is a manufacturer of products for the energy industry. The company offers services and products and integrated solutions to customers in the exploration, development, and production of oil and natural gas. Halliburton operates two business segments: Completion & Production and Drilling & Evaluation.

Our conviction in longer-term operating leverage is supported by the focus on improving cost structures. Upstream oil and gas spending over the longer term can benefit Exploration & Production (E&P) firms from sustained high oil and gas prices and a renewed urgency in global energy security. We believe the rightsizing of the company’s cost structure and forward focus on margins at the same time as E&Ps respond to new investment signals will drive both topline and bottom-line growth.

Sells

Ball

We sold Ball following a very disappointing second quarter earnings and outlook that has caused us to reevaluate the long-term growth potential of the North American beverage can market. The competitive environment appears to have increased more quickly than management has anticipated. We believe it is prudent to sell the entire position, as Ball is forced to reevaluate its growth strategy and shift its capital deployments. Market conditions in North America could spread to other global markets over the next couple of years.

Comcast

We sold our position in Comcast over concerns that the post-COVID slowdown in the company’s broadband net adds experienced in recent quarters will persist for the foreseeable future. The company faces increased competition in broadband from fiber and fixed-5G offerings that can deliver comparable or better service at lower prices. We believe that Comcast could respond to this competitive threat by cutting prices of its broadband and wireless bundle plans, which would pressure margins and EBTIDA growth. In addition, the company likely faces increased CapEx intensity as it seeks to keep its broadband service competitive.

Outlook

With the S&P 500 Index now trading at 15x forward earnings, we believe the multiple compression is reflected in current equity market valuation levels. The market focus has now shifted to the reduction in earnings estimates to reflect the expectations of a recession. This can impact the cyclical sectors compared to the growth sectors, feeling the brunt of the multiple contraction. International markets will likely continue to struggle with the sizable rise in commodity prices along with a stronger U.S. dollar adding to their woes. If there are any credit issues, it may very well show in either emerging markets or Europe. The two most important economic indicators we will be focused on are weekly unemployment insurance claims and the monthly Consumer Price Index (CPI). The Federal Reserve will likely continue to tighten until the tight labor markets ease. We believe the equity markets should rally on any material uptick in unemployment claims or a CPI that comes in below the consensus survey. Russia’s response to Ukraine’s recent success in regaining territory could also weigh heavily on markets in the fourth quarter. Our focus will continue to be at the company level, with an emphasis on companies with secular tailwinds or strong product driven cycles.

Disclosures

The opinions expressed herein are those of Aristotle Atlantic Partners, LLC (Aristotle Atlantic) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to purchase or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Atlantic makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle Atlantic Core Equity strategy. Not every client’s account will have these characteristics. Aristotle Atlantic reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Atlantic’s Core Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks.

The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Atlantic does not guarantee the accuracy, adequacy or completeness of such information.

Aristotle Atlantic Partners, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Atlantic, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request.

Composite returns for all periods ended September 30, 2022 are preliminary pending final account reconciliation.

The Aristotle Core Equity Composite has an inception date of August 1, 2013 at a predecessor firm. During this time, Mr. Fitzpatrick had primary responsibility for managing the strategy. Performance starting November 1, 2016 was achieved at Aristotle Atlantic.

Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses.

Aristotle Atlantic Partners, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Atlantic, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. This index has been selected as the benchmark and is used for comparison purposes only. The Russell 1000® Value Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Dow Jones Industrial Average® is a price-weighted measure of 30 U.S. blue-chip companies. The Index covers all industries except transportation and utilities. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite includes over 3,000 companies, more than most other stock market indices. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment grade bonds, including corporate, government and mortgage-backed securities. The WTI Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil consumed in the United States. The 3-Month U.S. Treasury Bill is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of three months. The U.S. Dollar Index (DXY) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the United States’ most significant trading partners. Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors. The volatility (beta) of the Composite may be greater or less than its respective benchmarks. It is not possible to invest directly in these indices.